BNB, the native token of BNB Chain, has slipped 1.7% in the last 24 hours, dropping from $659 to $646, as investor sentiment weakens ahead of a major U.S. Federal Reserve meeting and amid intensifying geopolitical unrest in the Middle East.

Heightened Uncertainty Pressures Price Action

The drop comes in response to escalating tensions between Israel and Iran, with U.S. President Donald Trump reportedly summoning the National Security Council for strategic discussions. This geopolitical stress, coupled with broader market uncertainty, has weighed heavily on risk assets, including cryptocurrencies.

BNB is now trading below the $647 support level, which had previously shown resilience, supported by a surge in trading volume reaching 82,311 tokens — nearly triple the average. The failure to hold this line suggests a bearish shift in short-term momentum.

Technical Setup Shows Bearish Tilt

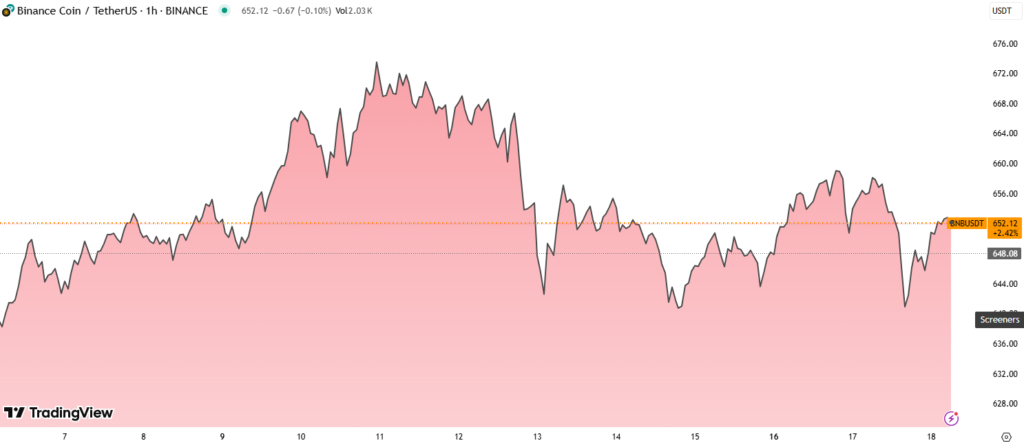

BNB’s hourly chart shows a local push to $655, followed by a retreat to $652, indicating resistance around $655.70–$655.80. Strong resistance remains at $658–$659, where BNB has been rejected twice on rising volume.

With price action now consolidating below resistance, the market is leaning toward a bearish bias. If sentiment remains weak, a break further below current levels could expose BNB to a deeper correction.

Fundamentals Still Intact

Despite the technical pressure, BNB Chain continues to demonstrate strong fundamentals. The network processed over $100 billion in DEX volume in the past 30 days, and more than $10 billion in the last 24 hours alone, according to DeFiLlama data. This underscores ongoing utility and user engagement across its ecosystem.

Traders are closely watching for the outcome of the Federal Open Market Committee (FOMC) meeting this Wednesday. Any indication of a rate hike or tightening monetary policy could reduce liquidity in risk-on markets, including crypto.

ETF Hopes Could Provide Long-Term Support

Adding to the long-term outlook, VanEck’s BNB ETF application, filed in May, remains under review. A positive outcome could unlock institutional demand and provide a strong foundation for future price appreciation.

Conclusion

BNB’s current decline below the $647 support level reflects short-term market unease driven by geopolitical risk and macroeconomic uncertainty. While the technical setup signals continued pressure, the underlying fundamentals of the BNB ecosystem remain strong. A pivotal moment lies ahead as traders await signals from the FOMC meeting, which could dictate the next major move in BNB price direction.

Disclaimer

This content is for informational purposes only and does not constitute financial, investment, or legal advice. Cryptocurrency trading involves risk and may result in financial loss.