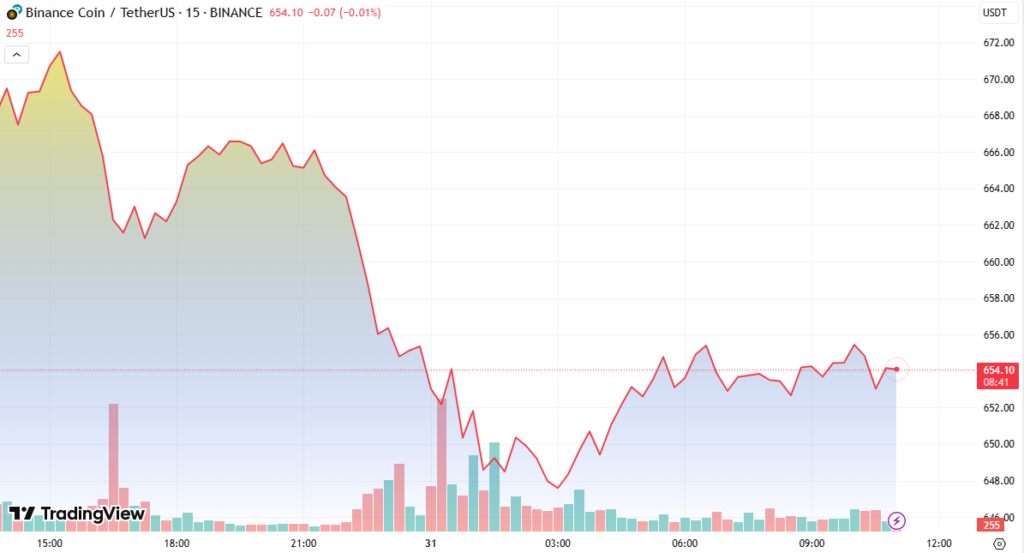

Binance Coin (BNB) recorded a 3.91% drop, falling from $672.53 to $646.27, as renewed global trade tensions triggered risk-off sentiment across financial markets. Despite a favorable development with the SEC dropping its lawsuit against Binance, macroeconomic instability drove investors to exit risk assets.

The bearish price action highlights how broader economic pressures can outweigh positive sector-specific news.

Trump’s Tariffs Spark Fear of New Trade War

The market downturn followed President Trump’s announcement of new tariffs on Canada and Mexico, sparking fears of a trade war and sending tremors through equities and crypto. BNB, closely tied to overall market sentiment, was particularly affected despite developments seen as bullish for its ecosystem.

The SEC’s voluntary dismissal of its long-standing lawsuit against Binance and its founder lifted a major regulatory cloud — yet failed to lift BNB’s momentum.

The case had accused Binance of operating an unregistered exchange and facilitating trades in unregistered securities, with the lawsuit active for nearly two years.

BNB Chain Activity Remains Strong

Despite the price dip, BNB Chain fundamentals remain intact. This week, BSC recorded 1.93 million daily active users, while opBNB crossed the 2 million mark. Weekly trading volume surged to $69.75 billion, and total value locked (TVL) hit $10.5 billion.

New launches include:

- UpTop (DeFi platform)

- Volare Finance (options protocol)

- WeApe by Wello (stablecoin payments)

Additionally, the BNB Chain AI Bot went live, the Maxwell Hardfork activated on testnet, and a real-world asset incentive program was launched. The BNB AI Hack concluded with prize announcements, while DappBay’s Featured Activities offered over $60,000 in user rewards.

Technical Outlook Remains Bearish

BNB established strong resistance at $669.68, with a major sell-off at 16:00 hitting 100,471 units in volume. A second wave of selling followed at midnight, pushing the price below $650, with volume spiking to 81,409 units.

A support zone has formed between $646–$648, but:

- Lower highs and lower lows persist

- A short-term ascending trendline is visible, offering temporary support

- The broader trend remains bearish, reflecting macroeconomic pressure

BNB’s near-term recovery will depend on whether technical support holds, and if global risk sentiment improves despite trade war concerns.