Binance Coin slips sharply, prompting renewed focus on long-term technical structure

The crypto market woke up to renewed volatility this week, and Binance Coin was no exception. BNB slid roughly 6%, trading near $821.99 in the early Friday session, as traders assessed whether the token’s impressive multi-month rally has finally run out of momentum. The pullback arrives after repeated attempts to reclaim higher territory, raising questions about near-term direction.

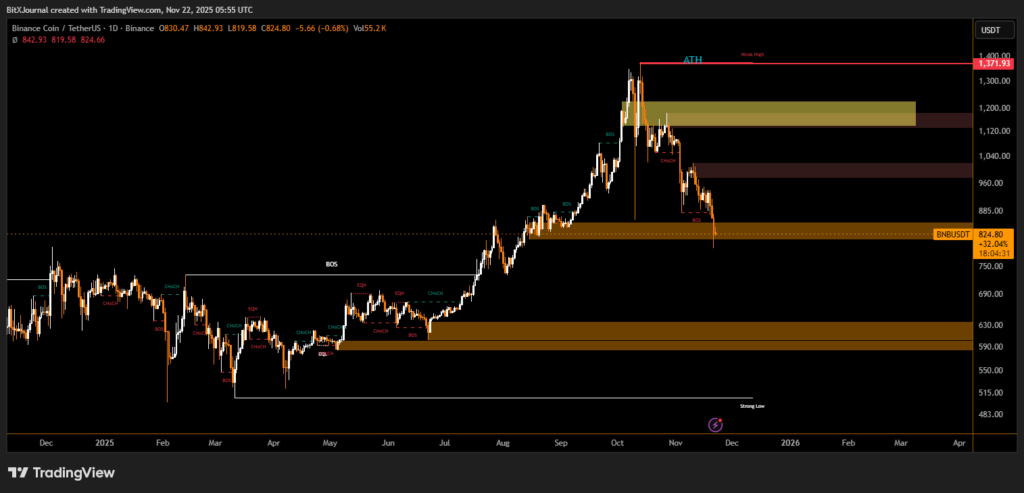

Analysts tracking the daily chart point to a decisive break of recent market structure, a shift that may signal the beginning of a deeper correction. The price is now hovering just above a critical support zone that has previously triggered strong rebounds. If that level fails, technicians warn that lower demand areas between $750 and $690 could come into play.

“Momentum has clearly cooled, and buyers are no longer as aggressive as they were in late October,” said BitXJournal digital-asset strategist. “The structure suggests a trend adjustment rather than a full reversal, but confirmation will depend on how price behaves around current support.”

The recent downturn follows a rapid advance earlier this quarter, when BNB surged toward its highest level on record. That rally stalled beneath a major supply region near $1,200, a barrier that traders say must be reclaimed for sentiment to fully recover. Until the market closes convincingly above that overhead resistance, upside may remain limited.

Volume indicators also reflect caution. Though selling pressure has not spiked dramatically, participants appear hesitant to re-enter, preferring to wait for a clearer signal. BitXJournal veteran market technician noted, “We are seeing a textbook retracement after an extended impulse. Whether this becomes a buying opportunity depends on the strength of the next reaction.”

Still, the broader fundamental backdrop has not shifted dramatically. Liquidity remains healthy, and institutional interest in established large-cap tokens continues. That environment may help prevent an uncontrolled slide, provided macro conditions remain stable.

For now, traders are watching the chart closely. If BNB holds above support and forms a higher low, bullish continuation remains possible. Conversely, a clean breakdown could open the door to deeper downside exploration.

As uncertainty lingers, market participants emphasize risk management and patience. The next move, they say, will reveal whether this week’s decline represents healthy consolidation—or the start of a more meaningful trend change.

Disclaimer

This content is for informational purposes only and does not constitute financial, investment, or legal advice. Cryptocurrency trading involves risk and may result in financial loss.