Rising volume and bullish structure hint at a possible reversal in the meme coin’s trajectory.

Bonk (BONK) recorded a 17% surge over the past 24 hours, reaching $0.00001259, as renewed market interest drove strong buying activity across meme-themed assets. The move comes amid heightened trading volume of over 130 billion BONK, reflecting growing confidence that the token may be preparing for a rebound after weeks of consolidation near a major demand zone.

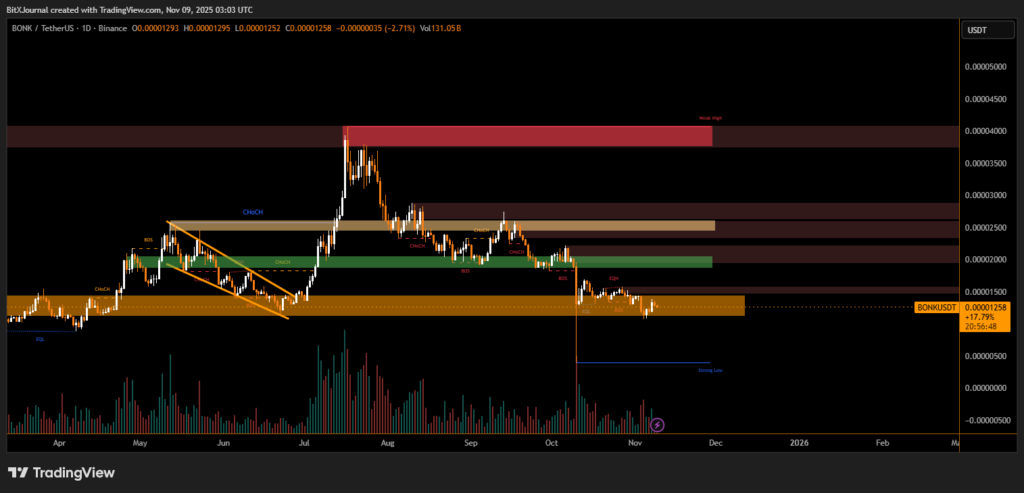

The daily chart reveals that BONK has successfully defended its key support level around $0.00001200, an area where accumulation patterns have historically formed. The rebound follows several failed attempts by sellers to push prices lower, indicating exhaustion among short positions.

BitXJournal Analysts note that BONK is now attempting to form a higher low, potentially signaling the early stages of a trend reversal. The chart shows that the token remains below a significant descending resistance channel, but a breakout above the $0.0000150 threshold could open room for a broader recovery toward $0.0000200.

BitXJournal crypto market strategist observed, “Bonk’s recent bounce looks technically driven. If the price sustains above $0.0000125, it could confirm a structural shift and attract momentum buyers looking for short-term gains.”

Support and Resistance Zones

Immediate support is anchored between $0.0000115 and $0.0000120, while resistance lies around $0.0000150 — a level aligned with previous liquidity sweeps and the base of the mid-range supply zone. A clean breakout above this level could validate bullish continuation, targeting the $0.0000200–$0.0000250 range where previous distribution occurred.

Conversely, failure to hold current levels could trigger a pullback toward $0.0000105, keeping BONK in a sideways-to-bearish structure.

Market Context and Sentiment

BONK’s price action mirrors a broader resurgence in meme coin demand, fueled by speculative interest and short-term liquidity rotations within the altcoin market. Trading volume spikes reinforce the narrative that buyers are regaining control, though analysts warn that sustained strength will depend on macro sentiment and Bitcoin’s price stability.

With BONK stabilizing above support and showing early signs of accumulation, the coming sessions will be crucial in determining whether momentum can carry it through overhead resistance. A confirmed breakout could mark the beginning of a short-term bullish cycle, while failure to follow through might see consolidation persist near the current range.

In summary, Bonk’s 17% rise underscores growing market confidence, supported by improving volume dynamics and renewed risk appetite across meme-focused cryptocurrencies.

Disclaimer

This content is for informational purposes only and does not constitute financial, investment, or legal advice. Cryptocurrency trading involves risk and may result in financial loss.