Market pullback signals renewed selling pressure as traders eye critical support at $0.00001200

BONK Technical Analysis: Resistance Rejection Triggers Correction

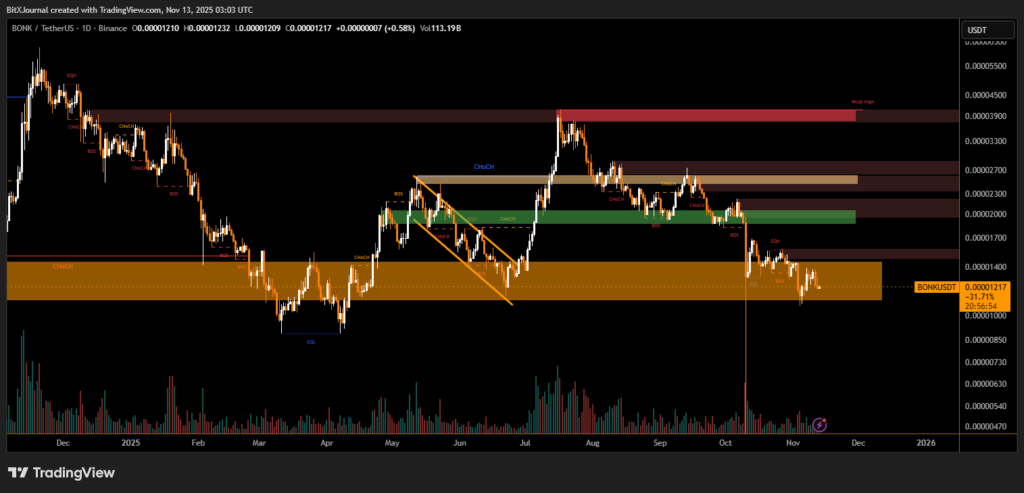

BONK (BONK/USDT) slipped 5% to $0.00001223 after facing a sharp rejection near the key resistance zone at $0.0000130, signaling renewed bearish sentiment in the meme coin’s short-term structure. According to TradingView data, the pullback was accompanied by a notable 50% surge in trading volume, suggesting aggressive profit-taking among traders after a brief recovery attempt.

The daily chart shows BONK struggling to sustain momentum above the mid-range consolidation zone. The asset has been repeatedly rejected from the supply area between $0.0000128 and $0.0000132, confirming this level as a strong barrier for buyers.

Key Support Levels and Market Structure

Technically, BONK remains in a broader bearish trend, with a series of lower highs and lower lows since its September peak. The current support area between $0.0000118 and $0.0000120 is being closely monitored by traders, as a decisive breakdown below this level could open the way for deeper losses toward $0.0000105 — a level last tested in late October.

Market structure analysis highlights multiple Breaks of Structure (BOS) and Change of Character (ChoCH) signals that confirm ongoing downside pressure. The failure to reclaim the $0.000013 resistance aligns with increased sell-side liquidity, indicating that short-term rallies continue to attract sellers.

“The price is showing clear rejection wicks from the supply zone, and with volume expanding, it signals that bears are defending the resistance aggressively,” said crypto technical analyst at BitXJournal Research.

“If BONK fails to hold above $0.0000120, we could see another liquidity sweep below the recent equal lows before any meaningful recovery.”

Investor Outlook and Near-Term Forecast

While BONK’s long-term narrative remains tied to Solana’s ecosystem recovery, traders are now cautious as the asset consolidates near multi-week lows. A daily close above $0.0000130 could invalidate the current bearish bias and pave the way toward $0.0000148 resistance.

For now, however, market sentiment remains neutral-to-bearish, with most traders waiting for a decisive move beyond the consolidation range.

Technical traders emphasize that sustained volume above $0.0000130 is required to confirm a bullish breakout, while a daily close below $0.0000118 would strengthen the bearish continuation case.

Disclaimer

This content is for informational purposes only and does not constitute financial, investment, or legal advice. Cryptocurrency trading involves risk and may result in financial loss.