The Solana-based meme coin extends its rebound above key resistance, supported by a sharp rise in trading volume.

BONK (BONK/USDT) rose 1.7% to $0.00001332 on Monday, extending its rebound after a technical breakout above the $0.00001300 resistance level. The move came as trading volume surged more than 82% above daily averages, suggesting renewed buying interest after weeks of consolidation.

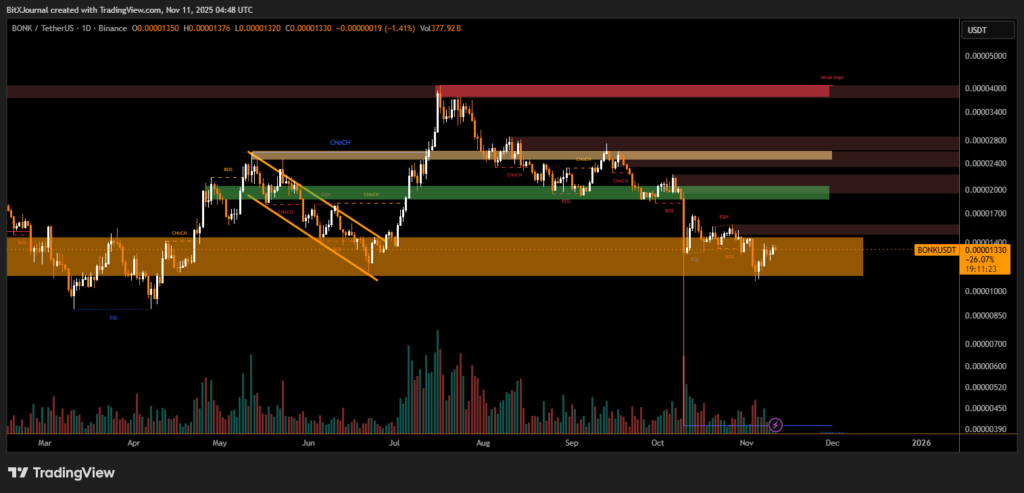

According to on-chain and market data, BONK has been trading within a broad accumulation zone between $0.00001100 and $0.00001400 since mid-October. A sustained close above this level could confirm a short-term reversal, setting the stage for a possible retest of $0.00001700, the next key resistance seen on the daily chart.

“BONK’s structure shows a clear shift in momentum after multiple change-of-character (ChoCH) confirmations on the daily timeframe,” said BitXJournal market analyst at BitJournal. “As long as the token holds above its demand block, bulls could target the mid-range liquidity zone around $0.000017–$0.000020.”

The chart shows BONK breaking above a descending wedge formation formed between June and July, followed by several breaks of structure (BOS) indicating renewed bullish pressure. The volume profile also highlights stronger participation from buyers near the lower boundary of the range — a signal often associated with early-stage trend reversals.

Still, resistance zones remain overhead. Analysts caution that BONK must maintain daily closes above $0.00001300 to avoid slipping back into the lower support range.

“Momentum looks promising, but the market remains reactive to Bitcoin’s volatility,” noted BitXJournal digital asset strategist. “If Bitcoin corrects, BONK could retest $0.00001150 before any continuation upward.”

Currently, the weak high near $0.00004000 marks BONK’s next major liquidity target if bullish pressure persists into the final quarter of the year.

BONK’s rising volume, confirmed structure breaks, and sustained accumulation pattern indicate growing investor confidence in the token’s near-term outlook.

Disclaimer

This content is for informational purposes only and does not constitute financial, investment, or legal advice. Cryptocurrency trading involves risk and may result in financial loss.