BTC Faces Renewed FOMO and Rising Volatility Ahead of Federal Reserve Rate Announcement

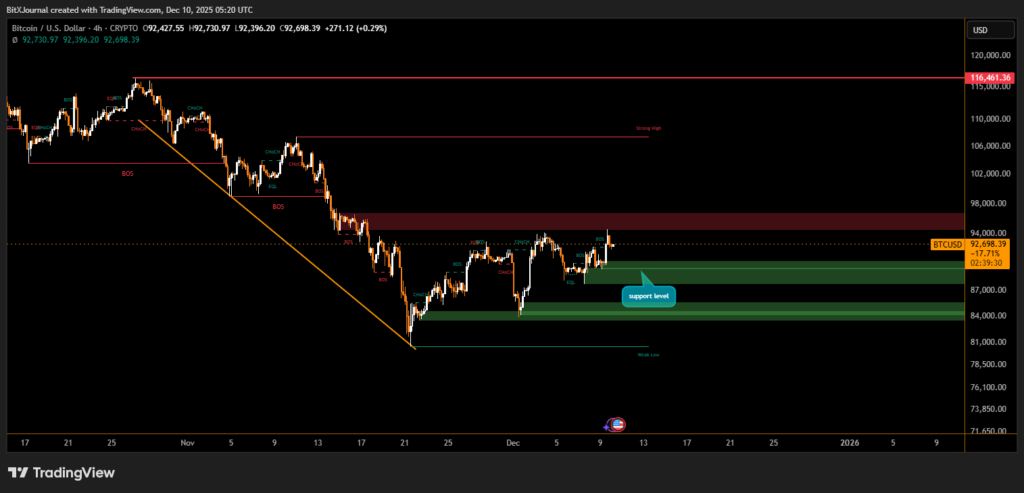

Bitcoin climbed to $94,625, marking its highest level in three weeks, as traders rushed back into the market and social sentiment flipped sharply positive. Data from market analysts shows a strong wave of FOMO-driven activity, with online discussions filled with calls for “higher” and “above” as BTC briefly reclaimed momentum.

However, the rally began to fade quickly, with prices slipping back toward $92,400, raising fresh uncertainty. Analysts note that markets often move opposite to retail behavior, and the sudden enthusiasm may indicate overheated expectations rather than sustainable strength.

The next major catalyst and potential risk is the Federal Reserve’s interest rate decision, scheduled for Wednesday. Futures markets currently show an 88.6% probability of a 0.25% rate cut, a key driver behind Bitcoin’s recent upswing. Analysts warn that Bitcoin’s reaction may depend less on the cut itself and more on the Fed’s tone regarding future monetary easing.

Any hesitation on additional rate cuts could pressure Bitcoin and broader crypto markets, as inflation concerns remain central to the Fed’s outlook. Current futures pricing reflects only a 21.6% probability of another cut in January, adding to the uncertainty.

With the FOMC decision expected to trigger sharp volatility, Bitcoin’s immediate direction remains finely balanced between renewed optimism and macroeconomic caution.

Disclaimer

This content is for informational purposes only and does not constitute financial, investment, or legal advice. Cryptocurrency trading involves risk and may result in financial loss.