Downside flows from old wallets, shifting macro expectations, and options markets turning defensive deepen pressure on Bitcoin.

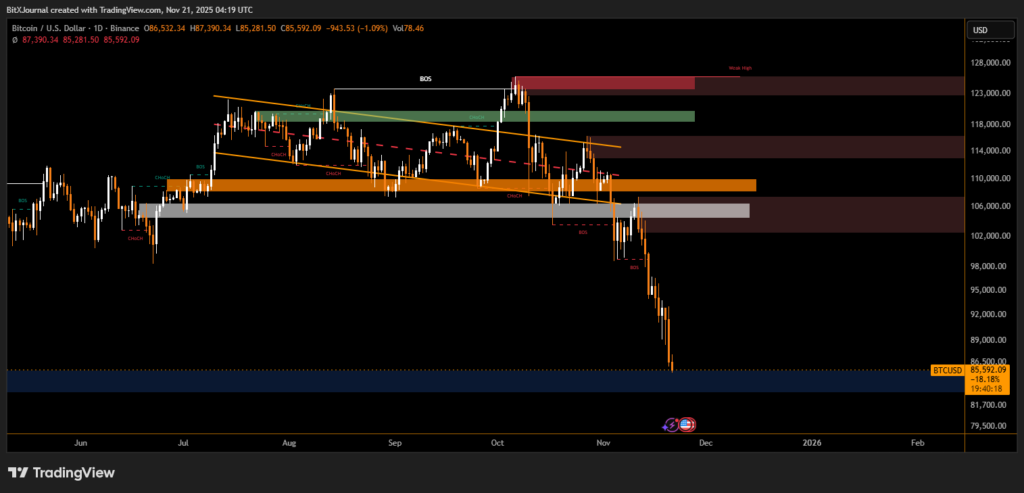

Bitcoin has slid toward the mid-$80,000 zone as market structure continues to weaken into the final weeks of the year. A combination of sustained sell pressure, hawkish macro repricing, and bearish options positioning has pushed sentiment into its most defensive posture since early summer. The pullback follows months of distribution and a clear breakdown across key technical levels, as shown in the latest chart data.

Technical Breakdown Suggests Shift in Trend

BTC’s sharp decline accelerated after losing support near the $92,000–$95,000 range, followed by a confirmed break of structure (BOS) across multiple timeframes. Current price action is interacting with a major liquidity pocket between $84,000–$86,000, an area that previously acted as demand during early Q3.

BitXJournal Analysts warn that losing this zone could expose deeper targets toward the high-$70,000s, though some view it as a potential higher-timeframe rebalancing phase.

BitXJournal senior market technician at a trading desk noted that:

“The rejection from the upper supply bands and the clean BOS signals across daily levels indicate the market is now firmly in a corrective leg. Until a clear reclaim above $98,000, trend continuation remains off the table.”

Old Wallet Selling Adds to Pressure

Market-making firm FlowDesk highlighted ongoing sell-side activity from dormant and older wallets, contributing to a persistent oversupply effect.

“We continue to observe steady distribution from old addresses that had remained inactive for years. This type of flow generally aligns with macro uncertainty and localized liquidity thinning,” BitXJournal said.

These movements underline an important trend: long-term holders are reducing exposure, a behavior historically associated with mid-cycle corrections.

Fed Repricing Intensifies Risk-Off Sentiment

Crypto derivatives desk QCP reported a sudden repricing of Federal Reserve expectations, with traders increasingly preparing for a “higher for longer” scenario.

“What changed was the market’s shift toward a delayed rate-cut cycle. That alone has pressured all risk assets, and Bitcoin is not immune,” QCP explained.

This shift has strengthened the dollar while hurting appetite for high-beta assets.

Options Market Turns Bearish

Data from derivatives markets shows downside protection now dominating, with put-skew widening and traders positioning for further weakness.

BitXJournal Deribit strategist stated:

“We’re seeing demand cluster around the $80,000 and $78,000 strikes. This reflects a clear hedging bias and expectations that volatility could expand if the current support fails.”

With weakened technical structure, rising macro uncertainty, and aggressive hedging across options markets, Bitcoin enters year-end with elevated downside risk. The $84,000–$86,000 region remains the immediate line in the sand. A decisive break may open the door to the next major liquidity zone below, while a strong reclaim would be the first signal of stabilization.

Disclaimer

This content is for informational purposes only and does not constitute financial, investment, or legal advice. Cryptocurrency trading involves risk and may result in financial loss.