Market Regains Short-Term Strength as Buyers Defend Key Demand Zone

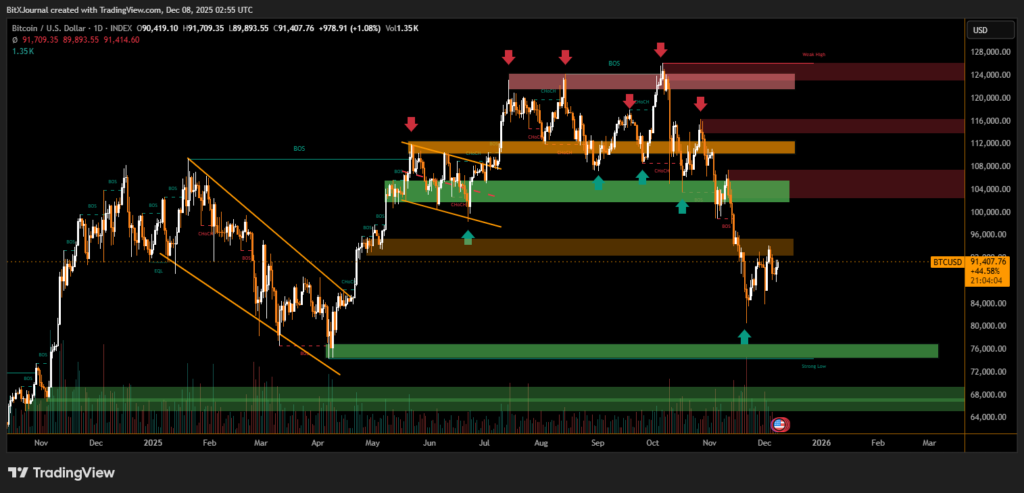

Bitcoin staged a notable recovery after briefly dipping below the $88,000 liquidity pocket, a level that had attracted significant attention among traders anticipating a potential sweep before any upward continuation. The chart confirms that BTC tapped the deep demand zone and immediately reacted with a strong rebound toward $92,000, signaling renewed buyer interest.

The price action shows a clear break-of-structure (BOS) following the rapid bounce, indicating that short-term momentum has shifted back toward the bulls. This reaction came precisely as BTC entered the previously highlighted green demand block, an area that has historically supported sharp reversals in market sentiment.

Market structure suggests that a successful hold above $90,500–$91,000 is crucial to maintain this rebound. A continuation toward the next major supply zone around $96,000–$100,000 becomes more likely if buyers defend this newly reclaimed zone.

At the same time, the market shows several unmitigated supply areas above current price, which could act as natural points of resistance. The $104,000–$108,000 supply block remains the most influential upside barrier, and only a clean break above it would open the way for a retest of the broader high-timeframe range near $120,000.

Still, the current move highlights that the market is respecting technical levels with precision. The liquidity sweep below $88K removed weak longs and invited stronger bids, creating the conditions for this rebound. If Bitcoin maintains its structure and volume supports the move, a push beyond $92K could validate a short-term trend reversal leading into the next trading week.

Disclaimer

This content is for informational purposes only and does not constitute financial, investment, or legal advice. Cryptocurrency trading involves risk and may result in financial loss.