Market eyes $110K support as traders weigh potential rebound or deeper correction

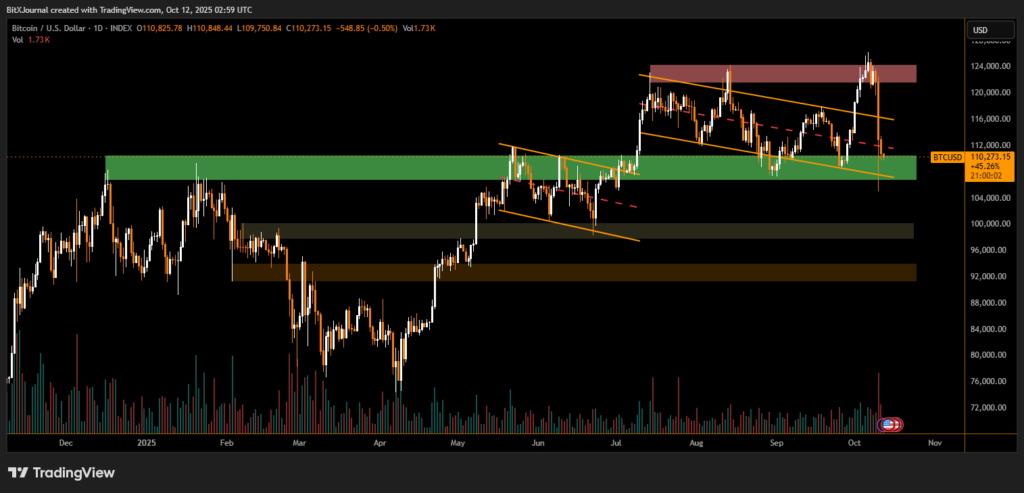

Bitcoin is currently hovering around the critical $110,000 support zone, testing one of its most important technical levels after a steep sell-off earlier this week. The correction follows a rejection from the $124,000 resistance region, leaving traders debating whether the move marks the start of a broader downtrend or a temporary pullback in an extended bullish cycle.

The daily chart shows Bitcoin retracing sharply from the upper boundary of a descending channel, with price now sitting inside a major green demand zone between $108,000 and $111,000 — an area that previously acted as strong resistance before the July breakout.

“This green band represents a make-or-break level for short-term momentum,” said one of BITX market analyst. “If Bitcoin holds here, we could see a rebound toward $118,000–$120,000. But a daily close below $108,000 could open the door to a deeper slide toward $96,000 or even $92,000.”

On the upside, the $122,000–$124,000 range remains a strong resistance zone, marked by repeated rejections and heavy sell volume. This red region has capped Bitcoin’s advance multiple times, suggesting profit-taking among whales and institutions.

Meanwhile, the volume spike accompanying the recent sell-off signals heightened market participation, often seen during major turning points. A rebound with low volume would indicate weak buying pressure, while a high-volume recovery could confirm renewed bullish interest.

“The structure still favors long-term bulls, as Bitcoin continues to respect higher lows since April,” According to BITX analysts. “But short-term traders should watch the $110K support closely — losing it could shift sentiment fast.”

Bitcoin’s immediate trend hinges on the $108K–$111K zone. Holding above this region could spark a relief rally, while a breakdown might extend losses toward lower support areas. As volatility rises, traders are advised to remain cautious and monitor volume confirmation before entering new positions.

Disclaimer

This content is for informational purposes only and does not constitute financial, investment, or legal advice. Cryptocurrency trading involves risk and may result in financial loss.