BTCS Inc., a blockchain technology-focused company, has announced plans to raise $57.8 million in a strategic move to invest heavily in Ethereum (ETH). The company believes Ethereum is currently at a “critical inflection point” in its development and value trajectory, making this a timely opportunity to deepen its exposure. This marks one of the largest direct ETH acquisition plans by a publicly traded blockchain firm.

Raising Capital: The Mechanics of the Deal

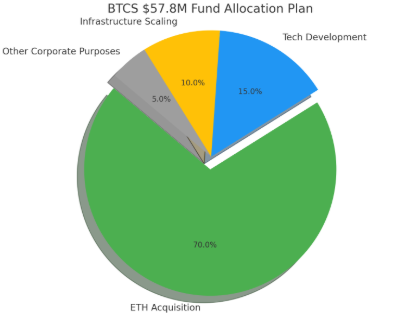

BTCS plans to raise the $57.8 million through an underwritten public offering of shares and warrants. The funds will primarily be used to purchase Ethereum directly, with the goal of holding it as a core asset on the company’s balance sheet. According to the filing, BTCS may also use a portion of the funds for general corporate purposes, including technology development and infrastructure scaling.

The company emphasized that the decision is not a short-term speculative play but part of a long-term thesis about the future role of Ethereum in the decentralized economy.

Why Ethereum? Understanding the Inflection Point

BTCS described Ethereum’s current phase as a “critical inflection point,” referring to several converging developments:

- Ethereum’s Shift to Proof-of-Stake (PoS) – The network has fully transitioned from proof-of-work, drastically reducing energy consumption and increasing scalability.

- Layer-2 Adoption – Ethereum’s ecosystem is expanding rapidly with the adoption of layer-2 solutions such as Arbitrum and Optimism, improving transaction efficiency and lowering fees.

- Institutional Interest – There is a surge in institutional attention toward Ethereum, especially as ETH-based ETFs and regulated products edge closer to approval.

Charles Allen, CEO of BTCS, stated, “Ethereum is not just a cryptocurrency—it is the backbone of a new digital economy. We believe now is the time to make a significant commitment before wider adoption accelerates.”

Market Reaction and Industry Implications

The crypto market responded cautiously to the announcement. While ETH prices remained relatively stable, the move has sparked discussion among analysts and investors about whether more blockchain companies will follow suit.

If successful, BTCS’s raise and ETH purchase could pave the way for a new wave of corporate crypto holdings—focused not only on Bitcoin, as in recent years, but also on Ethereum as a programmable asset with significant utility.

Moreover, the investment aligns with BTCS’s broader mission of advancing blockchain infrastructure. The firm already operates a staking-as-a-service platform and supports blockchain data analytics.

Conclusion: A Bold Bet on Ethereum’s Future

BTCS’s plan to raise nearly $58 million to invest in Ethereum represents a bold and strategic bet on the asset’s long-term value. At a time when Ethereum is evolving into a more scalable, efficient, and institutionally accepted platform, the move could position BTCS as a leading public company investor in the Ethereum ecosystem. Whether this strategy will pay off depends on Ethereum’s continued development and market adoption—but the conviction behind the move is clear.