Crypto mining hardware manufacturer Canaan Inc. has received a formal warning from Nasdaq after failing to meet the exchange’s minimum bid price requireement putting the company at risk of delisting if corrective action is not taken.

According to company disclosures, Canaan’s shares have closed below $1 for more than 30 consecutive trading days, triggering non-compliance with Nasdaq listing rules. As a result, the company has been granted a 180-day grace period, ending July 13, to regain compliance by ensuring its stock closes at or above $1 for at least 10 consecutive trading days.

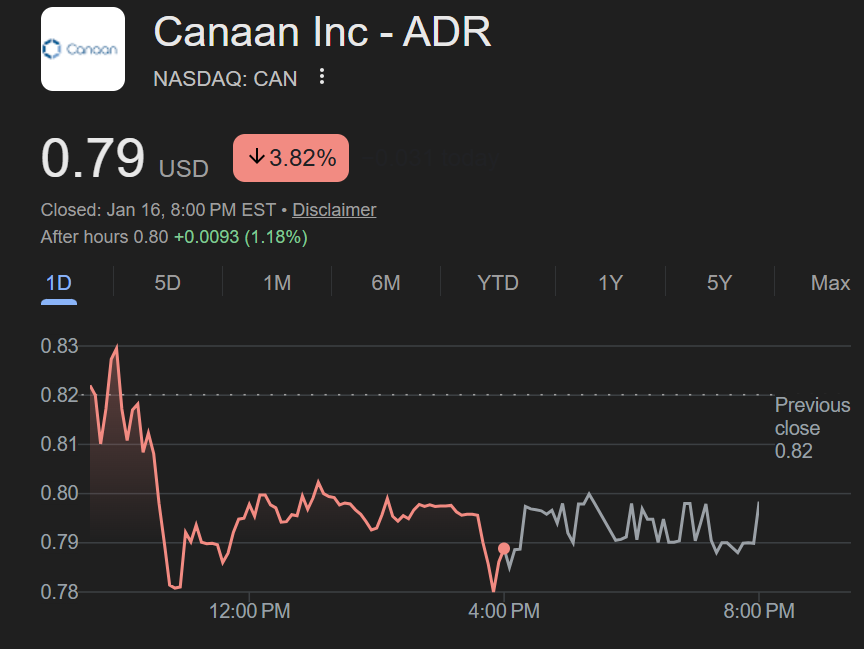

Canaan’s stock performance has deteriorated sharply, with shares down roughly 63% over the past 12 months and last trading near $0.79. The company has not seen its share price exceed $3 since December 2024, reflecting broader pressure across the crypto mining sector.

A key challenge has been reduced demand for mining hardware, as many large-scale miners pivot toward artificial intelligence and high-performance computing, reallocating capital away from bitcoin mining equipment. This structural shift has weighed heavily on hardware manufacturers.

Canaan noted that if it fails to meet the requirement by the deadline it may seek an extension or pursue a reverse stock split to boost its share price. Failure to secure approval would likely result in delisting, a move that typically reduces liquidity and investor access.

Despite recent setbacks large equipment orders and strategic adjustments remain critical factors that could influence whether Canaan can stabilize its market position before the deadline.

Disclaimer

This content is for informational purposes only and does not constitute financial, investment, or legal advice. Cryptocurrency trading involves risk and may result in financial loss.