Bitcoin miner Cango has raised $75.5 million in fresh capital as it pivots toward artificial intelligence infrastructure and high-performance computing. The funding includes a previously announced $10.5 million equity investment from Enduring Wealth Capital Limited and an additional $65 million in planned financing from entities linked to company chairman Xin Jin and director Chang-Wei Chiu.

The $10.5 million tranche was completed through the issuance of seven million Class B shares at $1.50 each. These shares carry 20 votes per share, lifting Enduring Wealth Capital’s voting power to 49.7%, up from 36.7%, while its economic stake remains under 5%.

The additional $65 million is expected to come from issuing roughly 49 million Class A shares at $1.32 each, pending regulatory approvals.

Bitcoin Sale Funds Debt Reduction and Strategic Pivot

Earlier this month, Cango sold 4,451 Bitcoin for approximately $305 million, using the proceeds to partially repay a Bitcoin-backed loan and reduce leverage. The move forms part of a broader strategy to reposition the company beyond mining.

Cango plans to repurpose its grid-connected mining infrastructure to provide distributed computing capacity for AI applications, aligning with rising demand for data center and compute resources.

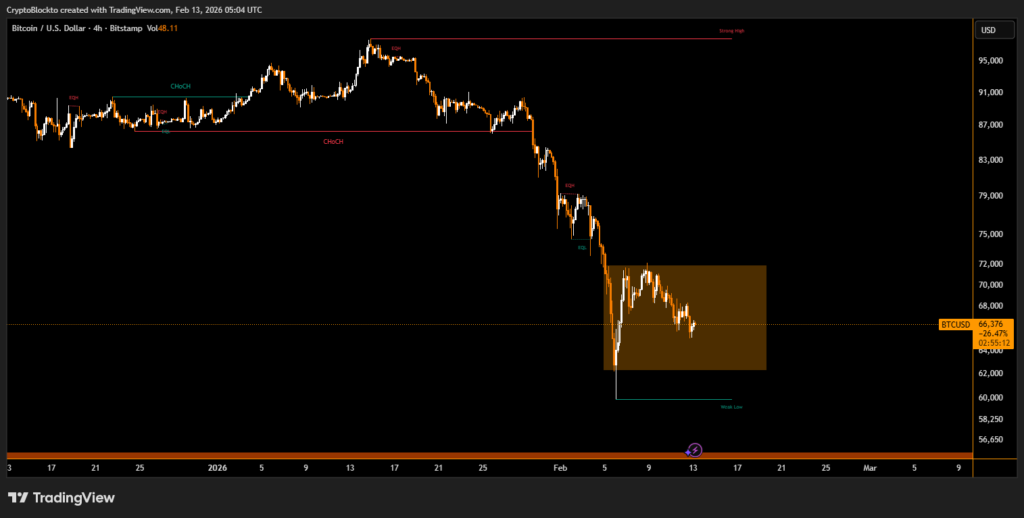

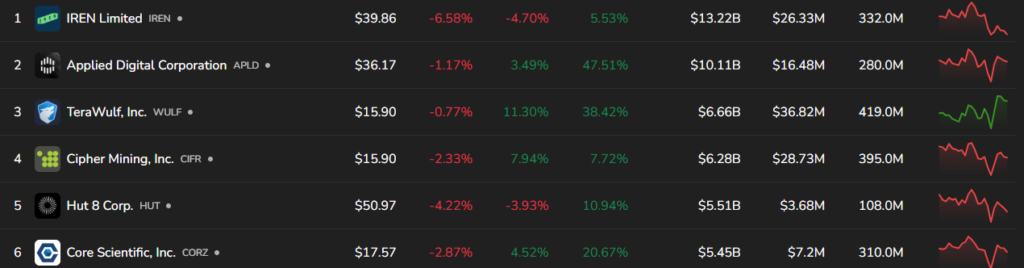

Mining Sector Faces Volatility

The capital raise comes amid broader pressure on publicly traded mining firms, as Bitcoin price swings and earnings misses have weighed on valuations. Despite recent declines, several mining stocks remain positive year-to-date, underscoring continued investor interest in infrastructure tied to digital assets and AI growth.

Disclaimer

This content is for informational purposes only and does not constitute financial, investment, or legal advice. Cryptocurrency trading involves risk and may result in financial loss.