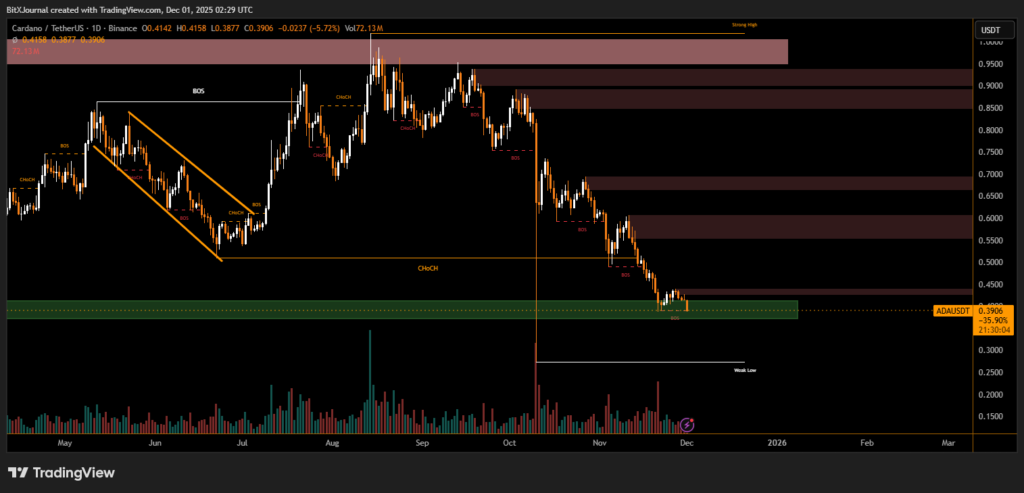

ADA retests a long-standing support area after repeated structure breaks

Cardano has fallen 6%, extending its multi-week decline and pushing the price toward a critical demand zone around $0.38–$0.40. The chart signals a continuation of bearish market structure, driven by successive breaks of structure (BOS) and repeated failures to reclaim upper supply zones.

Why Cardano Dropped 6%

The maket highlights a clear sequence of downward structure breaks, beginning after ADA’s rejection from the strong supply cluster between $0.90 and $1.00. Each recovery attempt since late October has been met with aggressive selling, creating a chain of lower highs and confirming bearish control.

A key event is the repeated CHoCH (Change of Character) signals, marking shifts from bullish attempts back into bearish continuation. Price consistently reacted to mid-range supply, failing to build momentum, which strengthened downside pressure.

Importantly, the break of minor supports and rising sell-side volume underline weakening bullish participation. The presence of a weak low beneath the current range suggests the market may still target lower liquidity before a significant reversal.

If ADA holds the $0.38–$0.40 zone, a short-term bounce could follow. However, continued failure to close above $0.45 would maintain bearish pressure and possibly open the path toward the next liquidity area near $0.30.

Cardano’s 6% drop reflects a technically aligned move driven by structure breaks, liquidity sweeps, and persistent supply rejection. The next reactions inside this key demand area will determine whether ADA stabilizes or extends its decline.

Disclaimer

This content is for informational purposes only and does not constitute financial, investment, or legal advice. Cryptocurrency trading involves risk and may result in financial loss.