Market structure weakens as sellers attempt to push ADA toward deeper liquidity levels

Cardano Tests a Critical Support Region

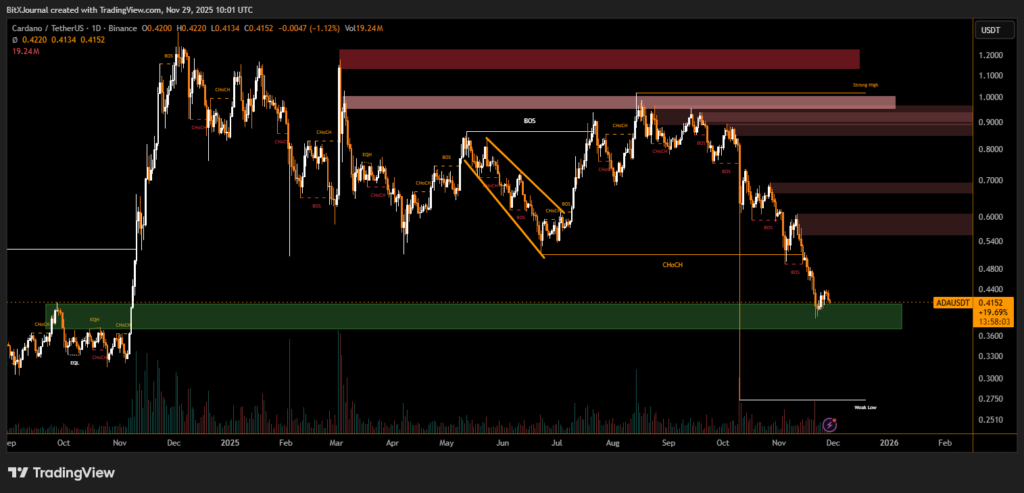

Cardano is trading near a key demand zone between $0.38 and $0.41, a region that has previously triggered sharp rebounds. However, current market structure suggests growing downside pressure, with sellers attempting to break below this support to extend the ongoing downtrend.

Cardano Technical Analysis Signals Renewed Bearish Momentum

Recent price action shows a series of lower highs and consecutive break-of-structure (BOS) moves, indicating sustained bearish control. On the daily chart, ADA has repeatedly failed to reclaim supply zones between $0.55 and $0.70, reinforcing the broader downtrend.

The highlighted chart zone shows that ADA has slipped back into a major green accumulation block that held as support earlier in October. Bears are now attempting to drive the price beneath $0.38, the lower boundary of this structure.

A decisive close below $0.38 would confirm bearish continuation and put the $0.27 liquidity level back into play.

Key Levels Traders Are Watching

- Immediate Support: $0.38–$0.41 demand zone

- Major Breakdown Level: $0.38

- Downside Target: $0.27

- Overhead Resistance: $0.48, followed by $0.55 and $0.70 supply zones

Volume analysis also shows elevated selling during the most recent downturn, suggesting that bears are aggressively defending every attempt at recovery.

While ADA has seen small intraday bounces, these have lacked strong follow-through. The broader structure highlights repeated change-of-character (CHoCH) shifts favoring sellers, and no significant bullish breaker block has formed to challenge the trend.

Unless buyers reclaim the $0.48 level and establish a higher low, ADA remains vulnerable to further decline.

Disclaimer

This content is for informational purposes only and does not constitute financial, investment, or legal advice. Cryptocurrency trading involves risk and may result in financial loss.