Cardone Capital Joins the Bitcoin Treasury Club

Cardone Capital, the $5.1 billion real estate investment firm led by Grant Cardone, has officially entered the digital asset space with the purchase of 1,000 Bitcoin (BTC) — worth over $101 million at current prices.

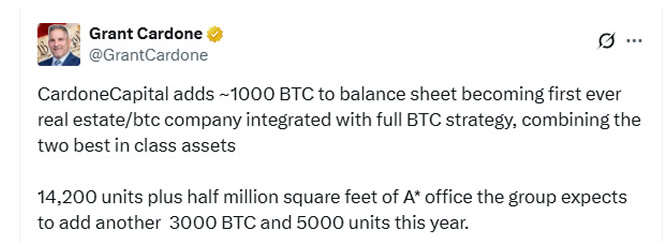

Announced via X, Cardone called it a “first-ever real estate/Bitcoin company integrated with a full BTC strategy,” marking a significant evolution in treasury diversification. He emphasized the move as a fusion of “the two best-in-class assets” — income-generating real estate and long-term appreciating Bitcoin.

Aiming for 4,000 BTC in 2025

Cardone Capital isn’t stopping at 1,000 BTC. The firm plans to acquire an additional 3,000 BTC by the end of 2025, potentially bringing its total Bitcoin holdings to over $400 million at current price levels. This would position it above several public miners like Core Scientific and Cipher Mining in terms of BTC holdings, according to data from BiTBO.

Real Estate-Backed Bitcoin Fund Launched

The purchase follows the launch of the 10X Miami River Bitcoin Fund in May, a dual-asset vehicle holding both a 346-unit multifamily complex in Miami and $15 million in Bitcoin. Grant Cardone noted that the idea was inspired by his brother and aims to use real estate cash flow to accumulate Bitcoin over time — a strategy blending stable yield with speculative upside.

Growing Institutional Adoption

Cardone Capital joins a growing list of companies pivoting toward crypto. Metaplanet, a Tokyo-listed firm, also bought 1,111 BTC this week, bringing its total holdings to 11,111 BTC, worth over $1.1 billion. Its aggressive accumulation reflects rising institutional confidence in Bitcoin as a reserve asset.

Conclusion: A New Treasury Model Emerges

Grant Cardone’s entry into Bitcoin signals a broader shift where traditional asset managers integrate crypto into legacy models. By pairing real estate’s predictable cash flow with Bitcoin’s long-term appreciation, Cardone Capital is pioneering a treasury model that may redefine diversification.

With more firms likely to follow, Bitcoin’s role as a strategic reserve asset is only set to grow.

Disclaimer

This content is for informational purposes only and does not constitute financial, investment, or legal advice. Cryptocurrency trading involves risk and may result in financial loss.