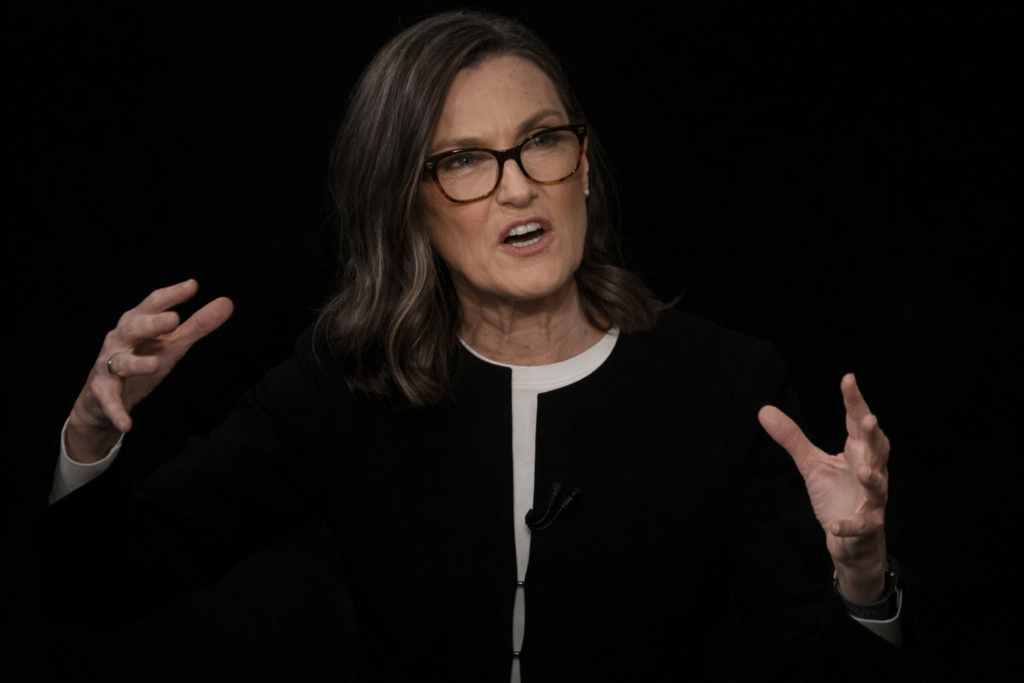

Ark Invest CEO Cathie Wood believes bitcoin is positioned to benefit not only from inflationary pressures but also from a powerful wave of deflation sparked by rapid technological progress. Speaking at a major bitcoin conference in New York, Wood argued that artificial intelligence, robotics, and other exponential technologies are driving costs lower at unprecedented speeds.

According to industry data she cited, AI training expenses have been declining by roughly 75% annually, while inference costs — the computing power required to generate AI outputs — have dropped by as much as 98% per year. These steep cost reductions are boosting productivity and enabling companies to deliver more output with fewer resources, placing downward pressure on prices across sectors.

Productivity Shock and Pressure on Traditional Finance

Wood described this shift as a “productivity shock” that could catch central banks and legacy financial institutions off guard. Economies accustomed to steady 2% to 3% inflation may struggle to adapt to rapid price declines driven by innovation rather than recession.

In that environment, she sees bitcoin’s fixed supply and decentralized structure as key advantages. Unlike debt-heavy financial systems vulnerable to margin compression and counterparty risk, bitcoin operates without reliance on central intermediaries. As innovation accelerates and disrupts traditional business models, Wood argues that bitcoin could emerge as a resilient alternative in an era defined by deflationary change.

Disclaimer

This content is for informational purposes only and does not constitute financial, investment, or legal advice. Cryptocurrency trading involves risk and may result in financial loss.