Cathie Wood’s Ark Invest has continued its aggressive push into crypto-linked equities, purchasing $21.3 million worth of Robinhood Markets (HOOD) shares through two of its exchange-traded funds, according to a Wednesday disclosure.

The Ark Innovation ETF (ARKK) bought 131,049 shares, while the Ark Next Generation Internet ETF added 36,440 shares of Robinhood. Combined, the purchases bring Robinhood’s weighting to about 19% across both ETFs as of Oct. 22, underscoring Ark’s growing conviction in the trading platform’s crypto expansion.

Throughout 2025, Ark Invest has steadily increased exposure to crypto-related stocks, adding positions in Robinhood, Bullish, Coinbase, and ETH treasury firm BitMine.

Robinhood’s Expanding Crypto Footprint

Robinhood has accelerated its digital asset push this year through a series of acquisitions and new initiatives:

- May 2025: Acquired Toronto-based WonderFi for $180 million, expanding its crypto presence into Canada.

- June 2025: Completed a $200 million acquisition of Bitstamp, one of the oldest global crypto exchanges.

- June 2025: Announced plans to launch its own Layer 2 blockchain built on Arbitrum.

- October 2025: Added BNB trading support, broadening its crypto trading lineup.

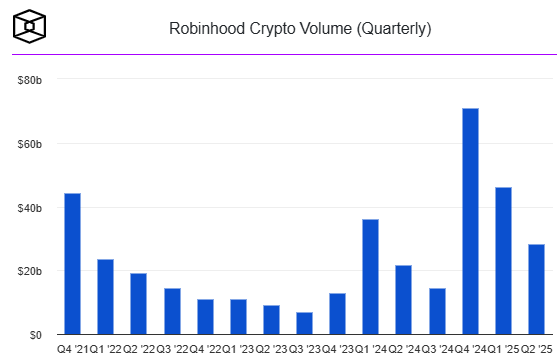

According to The Block’s data dashboard, Robinhood Crypto reported $28.3 billion in trading volume in Q2 2025 — a 24% year-over-year increase.

Despite the bullish institutional activity, Robinhood shares fell 3.5% on Wednesday, closing at $127.22.

Disclaimer

This content is for informational purposes only and does not constitute financial, investment, or legal advice. Cryptocurrency trading involves risk and may result in financial loss.