No-action letters ease data reporting pressure while maintaining collateral and transparency standards

The Commodity Futures Trading Commission has issued a set of no-action letters offering narrowly tailored relief to several U.S. prediction market operators. The move allows these platforms to bypass certain swap data reporting and record-keeping rules, provided they meet strict conditions designed to protect market integrity.

In its notice, the CFTC confirmed that its divisions overseeing market operations and clearing will not pursue enforcement actions against a select group of prediction markets as long as they adhere to defined obligations. The letters extend to Polymarket US, LedgerX, PredictIt, and Gemini Titan, giving each a measure of operational flexibility without altering existing law.

A key requirement is that all event contracts must be fully collateralized with assets held in reserve, ensuring traders’ positions are completely covered. The platforms are also required to publish time-and-sales data for every executed event contract, reinforcing transparency for participants.

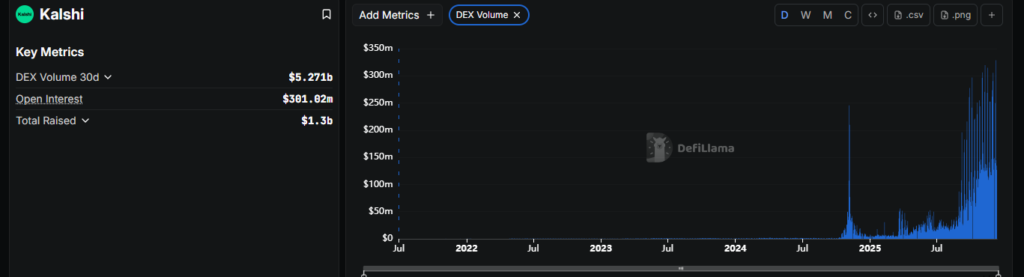

Prediction markets where users speculate on outcomes ranging from elections to entertainment—have surged in activity during 2025. Major platforms have reported strong multi billion-dollar monthly trading volumes, reflecting growing mainstream interest in event-driven markets.

While the no-action letters reduce immediate regulatory pressure, they serve as temporary guidance rather than permanent rule changes, giving regulators time to evaluate how prediction markets evolve in the broader derivatives landscape.

Disclaimer

This content is for informational purposes only and does not constitute financial, investment, or legal advice. Cryptocurrency trading involves risk and may result in financial loss.