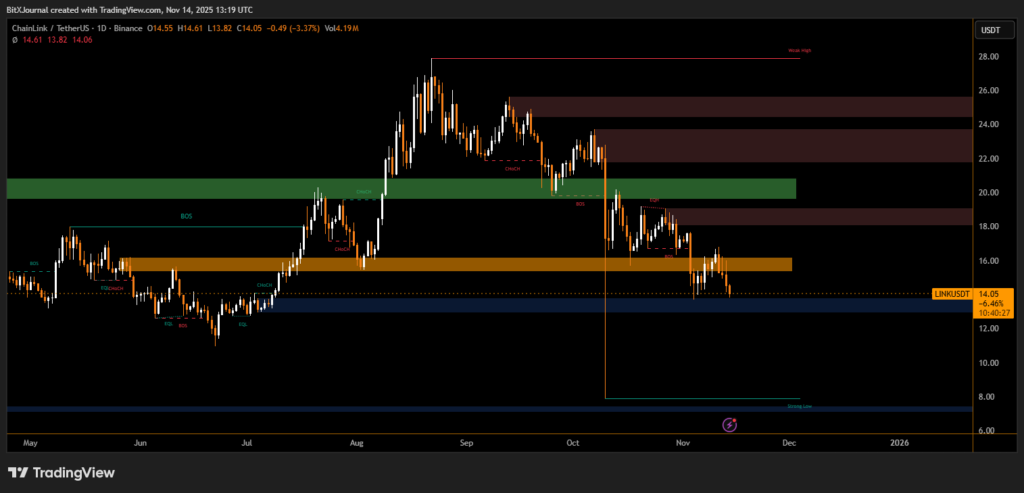

LINK/USDT price faces downward pressure, testing critical support levels amid market volatility

ChainLink (LINK) has fallen 8% in recent trading, testing significant support levels around $14 as bearish momentum builds. Technical indicators suggest traders are monitoring crucial zones that could determine the token’s near-term trajectory.

The daily chart shows LINK breaking below its orange support zone near $16, signaling potential continuation of the downtrend. The next major support lies at $13–$12.50, highlighted by the blue demand zone, which previously acted as a strong reversal area.

“LINK is currently testing key support that has historically triggered bouncebacks. Traders should watch the $12–$13 region closely for signs of accumulation or further breakdown,” said BitXJournal senior crypto analyst.

Recent price action reflects a series of Break of Structure (BOS) events, indicating repeated lower highs and lower lows, which reinforce the bearish trend. The green supply zone at $20 remains a key resistance level that could cap upward moves in the event of a recovery.

Market Dynamics and Trading Implications

The downward movement aligns with broader market volatility in altcoins, as traders rotate capital into stable or high-liquidity assets. LINK’s breach of intermediate support may prompt short-term traders to adjust positions, while long-term holders monitor for strong reversal signals.

“If LINK maintains levels above $12.50, we could see consolidation and gradual recovery. However, a break below this could accelerate selling pressure toward $10–$9,” noted BitXJournal market strategist specializing in DeFi tokens.

Key Levels to Watch

- Immediate resistance: $16 (orange supply zone)

- Critical support: $13–$12.50 (blue demand zone)

- Next strong support: $8–$7 (historical accumulation area)

Technical patterns indicate that LINK is navigating a crucial inflection point, and traders should monitor volume and momentum indicators for confirmation of trend continuation or reversal.

Disclaimer

This content is for informational purposes only and does not constitute financial, investment, or legal advice. Cryptocurrency trading involves risk and may result in financial loss.