Blockchain Oracle Leader Strengthens Position in Real-World Asset Market Amid Technical Rebound

The integration of Chainlink’s Cross-Chain Runtime Environment (CRE) into Balcony’s $240 billion real estate tokenization platform marks a pivotal step in connecting on-chain finance with traditional property assets. The partnership aims to bring verified government-sourced property data on-chain, allowing institutional investors to access tokenized real estate backed by transparent smart contracts.

According to Balcony’s team, the collaboration enables secure, automated data verification—a long-missing bridge between physical asset registries and blockchain ecosystems. “By leveraging Chainlink’s data infrastructure, we’re laying the foundation for an open real estate economy,” a Balcony spokesperson said.

Chainlink’s integration reflects the growing adoption of oracles in regulated asset markets. BitXJournal Analysts suggest that tokenization of real estate could soon become a multi-trillion-dollar industry, positioning Chainlink as a leading infrastructure provider.

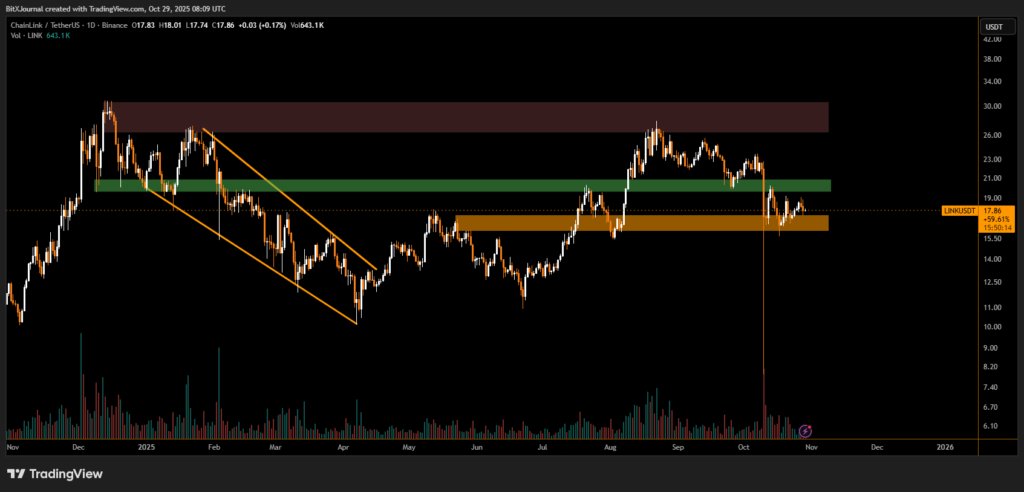

From a technical standpoint, LINK/USDT currently trades near $17.8, consolidating within a key demand zone identified between $16.0–$18.0. The chart shows a previous falling wedge breakout, followed by a retest of the breakout area—an often bullish continuation signal.

The next major resistance lies around $21–$23, while a clean move above this region could target the $28–$30 supply zone. Trading volume remains stable, suggesting accumulation despite recent volatility.

BitXJournal Market analyst noted, “Chainlink’s fundamentals are now directly tied to real-world adoption. The CRE integration adds tangible utility, which could support sustained upside if Bitcoin stability continues.”

The combination of strong fundamentals and technical resilience signals growing investor confidence in Chainlink’s long-term role in real-world asset tokenization.

Chainlink’s expanding ecosystem, led by institutional partnerships and steady technical support levels, continues to underscore its role as a backbone for blockchain–real-world integration.

Disclaimer

This content is for informational purposes only and does not constitute financial, investment, or legal advice. Cryptocurrency trading involves risk and may result in financial loss.