In a bold and unprecedented move, Chinese microchip manufacturer Nano Labs has officially launched its initiative to acquire up to 10% of the total circulating supply of BNB, Binance’s native token. The company confirmed on Thursday that it had completed a $50 million BNB purchase, marking the first step in a strategy that could reshape crypto treasuries.

Nano Labs Aims to Hold $1 Billion in BNB

Founded in 2019 by former Canaan Technology executives Kong Jianping and Sun Qifeng, Nano Labs (NASDAQ: NA) has publicly committed to investing up to $1 billion in BNB. The company has already accumulated $160 million in combined holdings of BNB and Bitcoin, according to its latest disclosure.

Their end goal is to control between 5% to 10% of BNB’s total circulating supply, a move that could place them alongside major holders like Binance and its founder Changpeng Zhao, who collectively own over 71% of the supply, per a June 2024 Forbes report.

At the current circulating supply of 145.8 million BNB and a market price of around $658 per token, Nano Labs would need nearly $926 million to reach the 10% milestone.

Market Reaction: Nano Labs Stock Dips Despite Bold Move

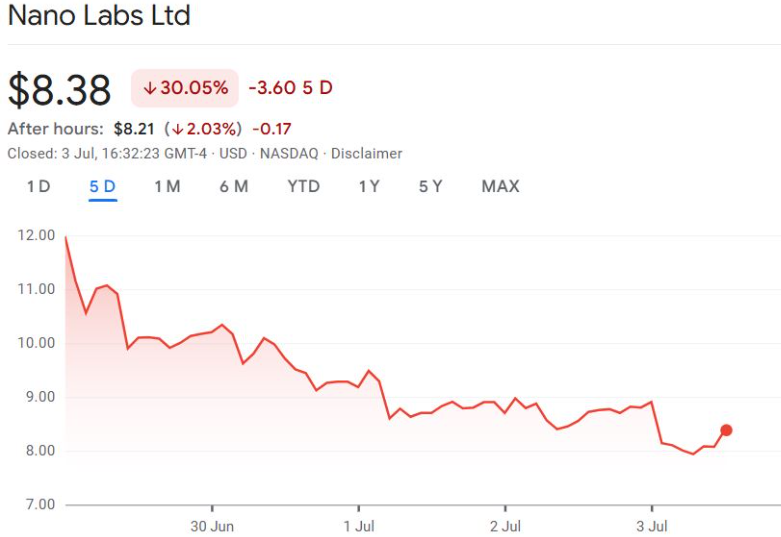

Despite the ambitious announcement, investor sentiment appears lukewarm. Following the $50 million BNB buy, Nano Labs’ stock fell 4.7% during regular trading on Thursday and dropped another 2% in after-hours trading, closing at $8.21.

This is in stark contrast to the 106% surge in stock price when Nano Labs first revealed plans to issue $500 million in convertible notes for the crypto treasury initiative.

Meanwhile, BNB itself remained relatively flat, gaining just 0.3% to trade around $663 despite the sizeable purchase.

Mixed Opinions on Corporate Crypto Treasuries

While Nano Labs pushes forward with its long-term BNB accumulation plan, market experts remain divided on the sustainability of crypto-focused treasuries.

Anthony Scaramucci, founder of SkyBridge Capital, expressed skepticism in a recent interview with Bloomberg. “If you’re giving somebody $10 and they’re putting $8 into Bitcoin, they’ll likely do well. But you might have been better off just putting all $10 into Bitcoin,” he said.

Scaramucci’s point: as crypto becomes more accessible, investors may increasingly choose to buy digital assets directly rather than invest in companies that hold them on balance sheets—raising questions about the long-term appeal of crypto treasuries.

BNB Supply and Outlook

BNB’s total supply is set to decrease over time due to regular token burns by Binance, further complicating Nano Labs’ accumulation strategy. If the current pace of burns continues, the available circulating supply could shrink—making it even more expensive for entities to acquire large stakes.

Nonetheless, Nano Labs’ move reflects a growing trend of integrating digital assets into corporate balance sheets, potentially boosting legitimacy and long-term demand for major tokens like BNB.

High Stakes for High Reward?

Nano Labs’ aggressive bet on BNB puts it in a rare league of corporate crypto whales. While the market is cautious and critics are vocal, the strategy—if successful—could provide long-term upside both for the company and the BNB ecosystem. Whether this sparks a new wave of crypto-focused treasuries or proves to be an overreach remains to be seen.

Disclaimer

This content is for informational purposes only and does not constitute financial, investment, or legal advice. Cryptocurrency trading involves risk and may result in financial loss.