Exchange to boost USDC liquidity, settlement efficiency and ecosystem-wide adoption through deeper integration

USDC is entering a new phase of global expansion as Circle strengthens its strategic ties with leading crypto exchange Bybit. The two companies announced a partnership designed to enhance liquidity, accessibility and cross-platform usability for the rapidly growing stablecoin which is nearing an $80 billion market valuation.

The collaboration will see Bybit integrate USDC more deeply across spot markets, derivatives trading and payment channels, reinforcing the exchange’s focus on operating within a transparent and compliant framework. According to the companies, the partnership aims to broaden USDCs role throughout Bybit’s ecosystem and improve the stability of settlement mechanisms for users worldwide.

Bybit representatives highlighted that the stablecoin is already embedded across the platform, powering trading pairs, savings products institutional settlement tools and fiat-payment channels. The new agreement is expected to deliver stronger liquidity provisioning, faster settlement and broader cross-chain functionality, especially in regions like the European Economic Area, where Circle benefits from regulatory approval under MiCA.

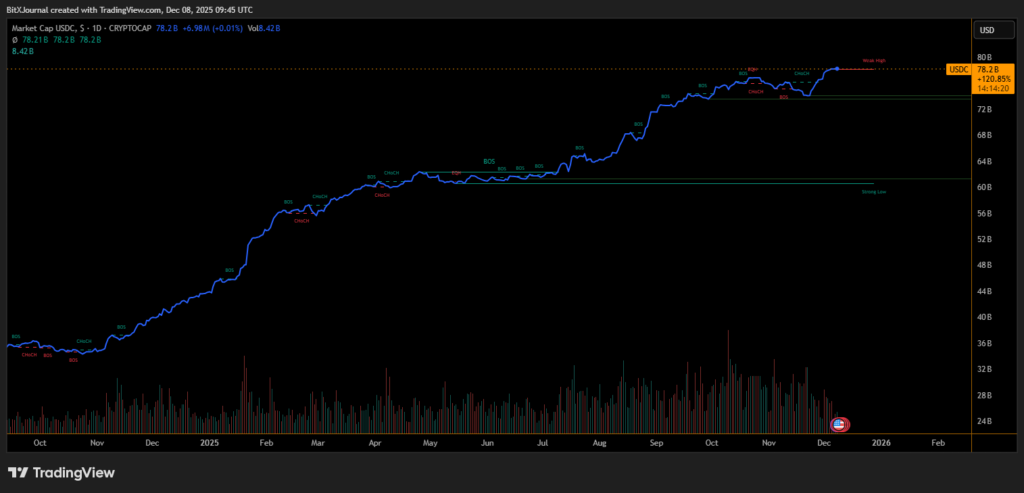

The timing aligns with a period of rapid expansion for USDC. The stablecoin’s market capitalization has climbed 77% since the start of 2025, rising from $44 billion to $78 billion, marking one of the strongest growth phases in its history. This surge reflects Circle’s push into traditional finance through partnerships with major institutions including Mastercard and Deutsche Börse.

While Bybit supports multiple stablecoins, the exchange emphasized that this collaboration is driven by an industry-wide shift toward regulatory clarity and transparent settlement, not exclusivity. With demand for compliant digital dollars increasing, the strengthened partnership positions USDC for even greater global adoption.

Disclaimer

This content is for informational purposes only and does not constitute financial, investment, or legal advice. Cryptocurrency trading involves risk and may result in financial loss.