Momentum is building in Washington for long-awaited digital asset legislation, with Ripple CEO Brad Garlinghouse stating that the proposed CLARITY Act now has a 90% chance of passing by the end of April. The bill aims to resolve one of the most pressing issues in the U.S. crypto sector: defining which digital assets qualify as securities and which fall under commodities regulation.

The legislation would draw a clearer line between oversight by the U.S. Securities and Exchange Commission and the Commodity Futures Trading Commission. Industry leaders argue that this distinction is essential to remove uncertainty that has slowed innovation and investment in the digital asset space.

CLARITY Act Could Reshape Crypto Oversight Framework

According to Garlinghouse, recent engagement between lawmakers, the White House, and both crypto and traditional financial executives has accelerated negotiations. While the bill has faced debate over stablecoin reward structures and yield-style incentives offered by platforms, discussions appear to be progressing.

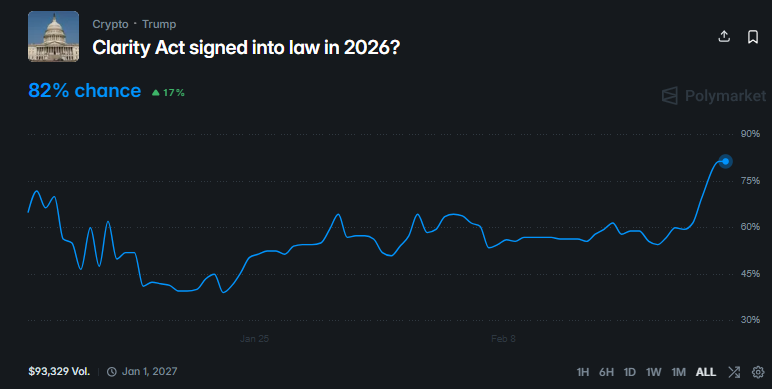

Prediction markets reflect growing optimism. On Polymarket, bettors currently assign an 82% probability that the bill will pass before year-end.

If enacted, the CLARITY Act would mark a significant shift in U.S. crypto regulation, offering clearer compliance pathways for firms and potentially strengthening the country’s position in the evolving global digital asset economy.

Disclaimer

This content is for informational purposes only and does not constitute financial, investment, or legal advice. Cryptocurrency trading involves risk and may result in financial loss.