Coinbase, the leading U.S.-based cryptocurrency exchange, is under legal fire once again. A proposed class-action lawsuit has been filed, accusing the company of failing to disclose a significant data breach, which allegedly led to a sharp drop in its stock price, causing investor losses.

The lawsuit claims Coinbase violated securities laws by not informing shareholders about the breach in a timely manner.

This legal battle follows multiple regulatory challenges faced by the exchange, including investigations by the SEC and ongoing privacy lawsuits tied to its user data handling practices.

What Triggered the Lawsuit?

According to court filings, the breach—first detected in late 2023—involved the unauthorized access of sensitive customer information, including names, email addresses, and trading activity. While Coinbase reported the breach publicly in early 2024, the plaintiffs argue that the delay in disclosure directly harmed investors.

“Had investors known the full extent of the breach earlier, they could have made informed decisions,” the complaint reads.

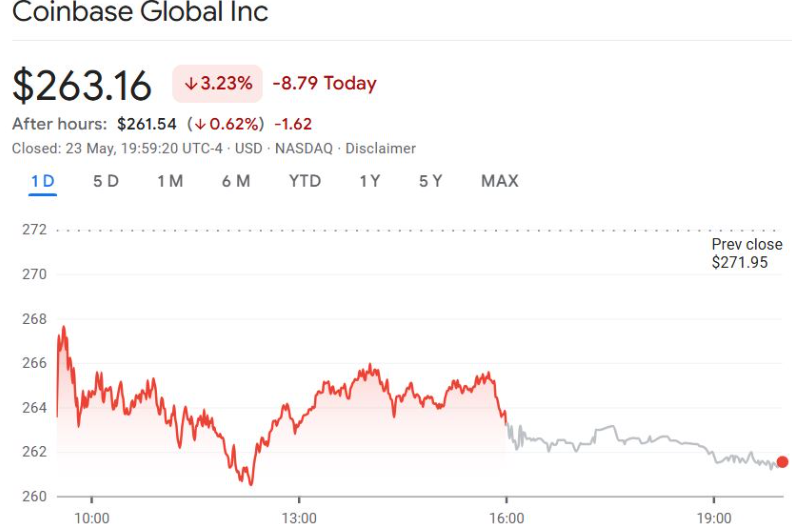

Following the public announcement, Coinbase’s stock (COIN) fell over 12% in a single trading session—erasing billions in market value.

Investors Allege Securities Fraud

The proposed class action, filed in a U.S. District Court, accuses Coinbase executives of violating Section 10(b) and 20(a) of the Securities Exchange Act, which prohibit misleading investors through omission or false representation.

Investors claim Coinbase misled the market by failing to disclose a material cybersecurity risk.

The legal team behind the suit is seeking compensation for all shareholders who purchased Coinbase stock between November 2023 and February 2024.

Coinbase Responds: “We Take Security Seriously”

In a brief statement, Coinbase reiterated its commitment to user safety and data protection, stating that the breach was “contained quickly” and that no user funds were stolen.

“We disclosed the incident as soon as it was appropriate under applicable laws and regulations,” a spokesperson said.

Coinbase also noted that the lawsuit is without merit and that it plans to vigorously defend itself in court.

What’s at Stake?

This lawsuit could set a precedent for how publicly traded crypto companies handle breach disclosures. It also brings into focus the growing intersection of cybersecurity, investor rights, and market volatility.

As scrutiny of crypto firms intensifies, transparency around security incidents is becoming critical for investor trust.

This case could influence future regulations—and reshape how digital asset firms report cyber threats.