Coinbase Global (COIN) is closing in on its record closing high of $357.39, set in November 2021, after surging to a 52-week intraday peak of $369.25 on Wednesday. The rally reflects renewed investor confidence in the U.S. crypto sector, driven by rising Bitcoin prices, pro-crypto policy momentum, and robust revenue growth.

Year-to-Date Rally Gains Strength

Coinbase stock has gained over 42% in 2025 and is now up 133% from its April low, which followed a market-wide downturn triggered by President Trump’s “Liberation Day” tariffs.

As of the latest session, COIN was trading around $352, giving the company a market capitalization of $89.6 billion—placing it among the most valuable crypto-focused firms globally.

Bitcoin, Regulation, and Revenue Driving Gains

Coinbase’s ascent is powered by three core factors:

- Bitcoin Price Surge: With BTC hovering near $107,000, investor optimism has spilled over into crypto equities.

- Pro-Industry Regulatory Signals: Bipartisan momentum behind legislation like the GENIUS Act and progress on stablecoin frameworks have reduced uncertainty.

- Solid Financials: In Q1 2025, Coinbase reported $2.03 billion in revenue, up 24.2% year-over-year, with subscription and services revenue climbing 36.3% to $698.1 million—driven in part by stablecoin income.

Boost From Circle’s IPO Success

Coinbase’s gains are also linked to the strong public debut of Circle Internet Group, issuer of USDC. After launching at $31 per share, Circle’s stock has soared above $200, reflecting massive investor demand for stablecoin infrastructure plays.

Coinbase holds an equity stake in Circle and partners closely with the firm on USDC issuance and adoption, a relationship that was formalized and expanded in 2023.

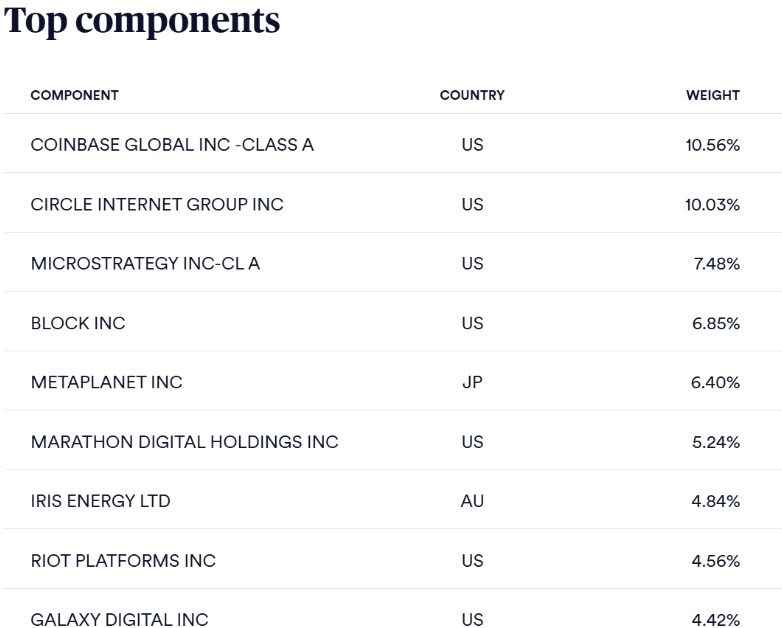

Circle briefly became the top holding in VanEck’s MVIS Global Digital Assets Equity Index (MVDAPP), further boosting exposure for Coinbase through ETF allocations.

Disclaimer

This content is for informational purposes only and does not constitute financial, investment, or legal advice. Cryptocurrency trading involves risk and may result in financial loss.