Bitcoin and Ether funds face first net redemptions in over a week

After days of record-setting inflows, crypto exchange-traded funds (ETFs) ended the week on a weaker note. On Friday, August 15, investors pulled a combined $73 million from Bitcoin and Ether ETFs, halting a winning streak that had fueled optimism across the digital asset market.

Bitcoin ETFs Face Modest Pullback

Bitcoin ETFs recorded $14 million in net outflows, despite strong institutional demand. BlackRock’s iShares Bitcoin Trust (IBIT) attracted $114 million in new capital, but losses at other funds offset the gains. Grayscale’s GBTC saw $81 million in redemptions, while Ark 21Shares’ ARKB shed nearly $47 million.

Trading activity remained elevated at $3.28 billion, yet total net assets slipped to $151.9 billion. Analysts say the data shows resilience even as investors reassess risk.

“After such strong inflows, a brief pause isn’t surprising,” said one market strategist. “The market is consolidating rather than reversing trend.”

Ether ETFs Post Sharper Losses

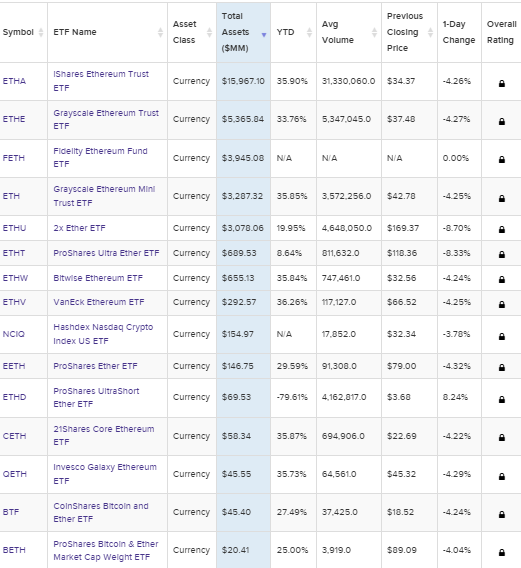

Ether funds faced a tougher session, with $59 million in outflows. BlackRock’s ETHA drew an impressive $338 million in inflows, but it wasn’t enough to offset steep redemptions elsewhere.

Fidelity’s FETH lost $272 million, while Grayscale’s ETHE saw $101 million exit. Smaller outflows hit Bitwise’s ETHW, 21Shares’ CETH, and Grayscale’s Ether Mini Trust. As a result, Ether ETF net assets declined slightly to $28.1 billion, with volumes at $3.54 billion.

According to market observers, the retreat reflects profit-taking after rapid gains earlier in the week. “Investors are locking in profits, especially in Ether, where inflows hit records just days ago,” explained a digital asset researcher.

Despite the red close, sentiment remains cautiously optimistic. The strong participation of major funds like BlackRock highlights continued institutional confidence in crypto-backed products.

As markets reopen next week, traders will watch closely to see if the outflows represent a short-lived pause or the start of a cooling trend.

Disclaimer

This content is for informational purposes only and does not constitute financial, investment, or legal advice. Cryptocurrency trading involves risk and may result in financial loss.