Crypto exchange-traded products (ETPs) experienced strong investor demand in the first half of 2025, although inflows dipped slightly compared to last year’s figures. According to recent data from digital asset manager CoinShares, global crypto ETPs recorded $17.8 billion in net inflows, representing a 2.7% decline from H1 2024, which saw $18.3 billion.

Bitcoin Leads the Pack With $14.9 Billion in Inflows

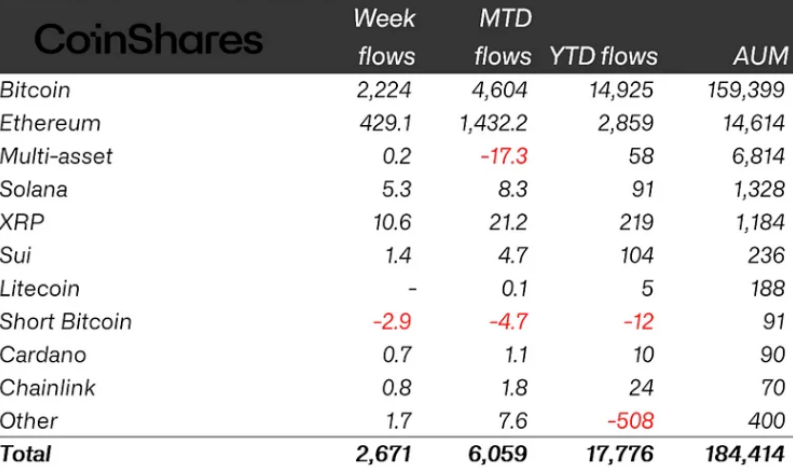

The data reveals that Bitcoin ETPs dominated the inflow chart, contributing 84% of all crypto ETP inflows in the first six months of 2025. Bitcoin-related products saw $14.9 billion in net investments, underscoring the asset’s continued appeal to institutional and retail investors alike.

- In just the last week of June, Bitcoin ETPs attracted $2.2 billion, maintaining their leading position.

- This trend mirrors Bitcoin’s strong price action, which rose from approximately $101,000 to over $107,800 between June 23 and June 30.

Ethereum and XRP Also Show Strength

Following Bitcoin, Ethereum ETPs captured $2.9 billion in inflows YTD, making up 16.3% of the total. Ether products saw $429 million in new capital last week alone.

Meanwhile, XRP ranked third, despite no U.S. approval for a spot XRP ETF yet. XRP ETPs accumulated:

- $10.6 million last week

- $219 million over H1 2025

This momentum follows Canada’s approval of spot XRP ETFs on June 18, which added credibility and investor interest to XRP-based instruments globally.

BlackRock Dominates Crypto ETP Issuers

BlackRock has emerged as the undisputed leader among crypto ETF issuers, capturing a massive 96% share of total H1 2025 inflows:

- $17 billion flowed into BlackRock’s crypto funds, particularly into its spot Bitcoin ETF (IBIT).

- In contrast, Grayscale Investments recorded outflows nearing $1.7 billion during the same period.

Other notable players include:

- ProShares: $526 million inflows

- Fidelity: $246 million inflows

11 Straight Weeks of Inflows Despite Market Volatility

CoinShares noted that the past 11 consecutive weeks saw steady inflows, accounting for $16.9 billion, or nearly 95% of the total H1 inflows. This consistent demand highlights growing confidence in digital assets, especially as crypto markets stabilize and regulatory clarity improves.

Key Takeaway

While crypto ETP inflows are slightly below last year’s levels, institutional appetite remains strong, especially for Bitcoin and Ethereum. With BlackRock leading the charge, and new entrants like XRP ETFs gaining traction, 2025 is shaping up to be a pivotal year for crypto investment products.

Disclaimer

This content is for informational purposes only and does not constitute financial, investment, or legal advice. Cryptocurrency trading involves risk and may result in financial loss.