As violent crimes targeting cryptocurrency holders rise, insurance companies are racing to develop kidnap and ransom (K&R) insurance policies tailored for crypto executives and investors.

A recent NBC News report reveals that at least three crypto-focused insurance and security firms are preparing new K&R protections to address growing threats of physical abductions and extortion in the digital asset world.

Crypto Wealth Now a High-Risk Target

Unlike traditional assets held by banks or custodians, crypto wallets are often self-managed, making high-net-worth individuals particularly vulnerable. If criminals gain access credentials, funds can be instantly transferred and laundered—leaving victims with no recourse.

Rebecca Rubenfeld, COO of AnchorWatch, noted that physical safety was a central concern at the recent Bitcoin Conference in Las Vegas. Her firm expects to roll out its crypto-specific K&R coverage by fall 2025.

“They’re tense,” Rubenfeld said, referencing attendees’ concerns. “People are aware of the growing threat.”

Real-World Attacks Are on the Rise

Physical assaults on crypto holders are not new, but recent high-profile incidents have amplified alarm across the industry:

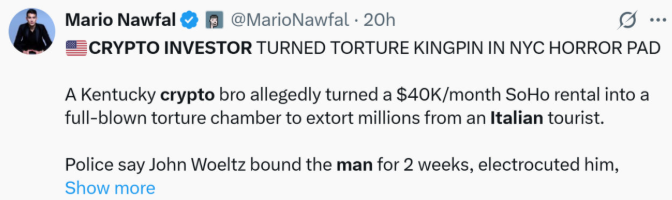

- In New York, an Italian tourist was tortured over access to his crypto accounts.

- In France, crypto executives including Pierre Noizat‘s family were targeted in a kidnapping attempt.

- On May 27, South Korean police arrested a Russian suspect for attempting to steal ₩1 billion (~$730,000) in a fake crypto transaction.

Insurers Adapt to New Risks

Traditional K&R insurance, historically used by corporate executives and diplomats, is now being customized for crypto professionals.

Joseph Ziolkowski, CEO of Relm Insurance, confirmed his firm is finalizing a crypto K&R product. However, pricing such policies is complex. “Security posture matters,” he noted. “Clients with 24/7 protection may pay significantly lower premiums.”

Andrew Kurt, VP at Hylant Capital, said crypto K&R coverage could remain profitable for insurers, as incidents are low frequency but high severity.

Security Firms See Rising Demand

The growing risk has also sparked demand for private protection services. Infinite Risks International, a private security company, reported a notable rise in bodyguard and protection requests from crypto clients in May.