Cryptocurrency investment products posted another strong week of inflows, attracting over $1 billion in fresh capital, according to the latest market data. The surge reflects ongoing investor appetite for digital asset exposure despite recent volatility in Bitcoin and Ethereum markets.

Bitcoin ETPs Lead, But Momentum Slows

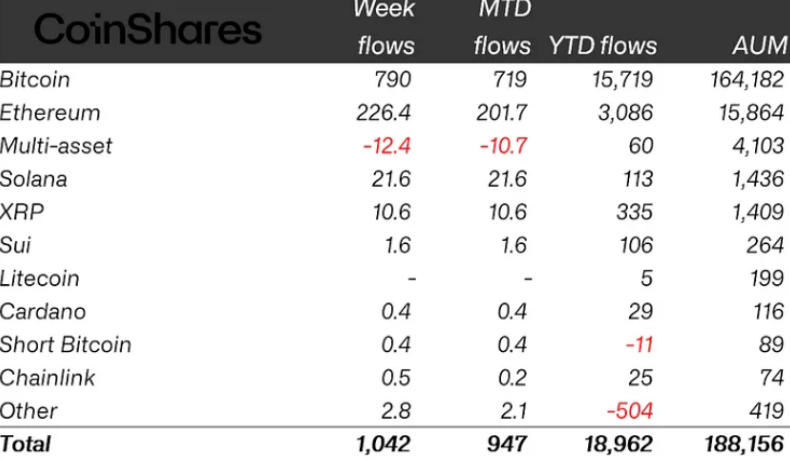

Bitcoin exchange-traded products (ETPs) led inflows with $790 million, representing 76% of total inflows. While this shows continued investor interest, it marks a slowdown from the $1.5 billion weekly average recorded over the prior three weeks.

Analysts suggest that the deceleration is likely due to growing investor caution, especially as Bitcoin approaches its all-time highs.

“The moderation in inflows suggests that investors are becoming more cautious as Bitcoin approaches its peak levels,” said one fund analyst.

Ether Investment Products Gain Ground

Ethereum-based ETPs attracted $225 million in inflows over the same period, continuing an 11-week streak of positive net capital movement. On a percentage basis, Ethereum products averaged 1.6% of AUM in weekly inflows, double the 0.8% seen in Bitcoin ETPs.

This shift points to a rising investor preference for Ethereum, potentially driven by optimism around Layer-2 ecosystems, staking yields, and the recent progress in Ethereum ETF approvals.

Record-Breaking AUM for Crypto ETPs

With this fresh wave of inflows, total assets under management (AUM) in global crypto ETPs rose to $188 billion, up from $184.4 billion the week prior. This sets a new historical high, and total year-to-date inflows have now reached just under $19 billion, breaking previous records.

The data also shows that BlackRock was the top contributor to last week’s inflows, handling $436 million, or 42% of total capital raised across all issuers.

Cautious Optimism in Crypto Markets

Despite short-term volatility, investor behavior continues to favor regulated crypto investment vehicles, such as ETPs and ETFs, for gaining exposure to the digital asset market. As Bitcoin’s price consolidates and Ethereum products gain traction, the market outlook remains constructive but cautious heading into Q3 2025.

Investors are advised to watch inflow momentum, ETF approvals, and macroeconomic signals closely as capital rotation continues within the crypto fund ecosystem.

Disclaimer

This content is for informational purposes only and does not constitute financial, investment, or legal advice. Cryptocurrency trading involves risk and may result in financial loss.