A Chinese-language crypto guarantee marketplace known as Xinbi continued to process significant transaction volumes despite platform bans and law enforcement pressure, highlighting the adaptability of crypto-based laundering services.

TRM Labs Finds Sustained Onchain Activity

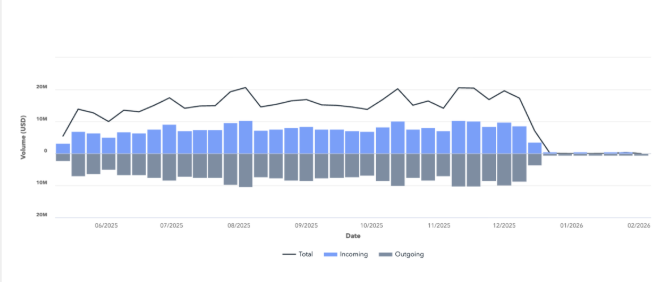

Blockchain analytics firm TRM Labs reported that wallets attributed to Xinbi processed approximately $17.9 billion in onchain transaction volume after coordinated enforcement actions and messaging platform bans in 2025. The figure represents gross transaction activity, including inflows, outflows, and internal transfers within Xinbi’s escrow and wallet infrastructure, rather than confirmed illicit proceeds.

According to the report, activity did not disappear after bans on major communication channels. Instead, Xinbi users migrated to alternative messaging services, allowing operations to continue with limited disruption.

Role of XinbiPay Wallet in Recovery

A key factor behind Xinbi’s resilience was the launch of its affiliated wallet service, XinbiPay. Onchain data shows that wallet inflows and outflows rebounded in early 2026 as users transitioned to the new setup. TRM Labs noted that internal fund recycling, a common feature of guarantee and escrow services, likely contributed to the high transaction volumes.

Alleged Links to Scam and Laundering Networks

Investigators allege that Xinbi has played a central role in facilitating laundering for scam operations, including large-scale fraud schemes. Earlier analyses had already flagged billions of dollars in stablecoin flows linked to the service.

TRM Labs concluded that enforcement actions have reshaped, but not dismantled, this layer of crypto-enabled laundering infrastructure, underscoring the challenges regulators face in disrupting decentralized financial crime networks.

Disclaimer

This content is for informational purposes only and does not constitute financial, investment, or legal advice. Cryptocurrency trading involves risk and may result in financial loss.