Retail crypto investors are widening their focus beyond market leaders as volatility persists, signaling a shift in behavior during the latest downturn.

According to Robinhood Head of Crypto Johann Kerbrat, trading activity remains steady despite falling prices. Many users are treating the pullback as a buying opportunity and expanding exposure beyond Bitcoin and Ethereum, traditionally the two dominant assets by market capitalization.

Altcoin Diversification Trends in a Weak Market

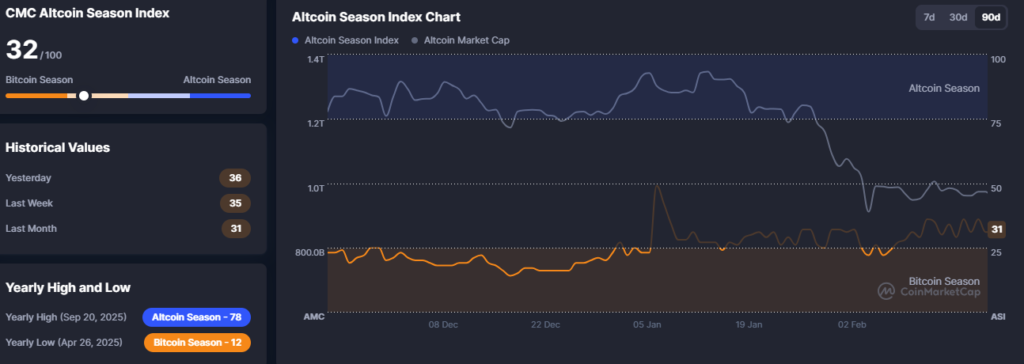

Market data supports the cautious tone. The Altcoin Season Index recently showed a Bitcoin Season score of 33 out of 100, indicating continued preference for Bitcoin over smaller tokens. However, investors appear increasingly willing to explore a broader range of assets, even as sentiment indicators remain subdued.

Institutional participation is also evolving. Executives at Coinbase Asset Management and MidChains have observed asset managers entering primarily through large cap tokens, with limited exposure to smaller-cap altcoins or decentralized finance strategies.

Crypto Staking and DeFi Activity Gain Momentum

Beyond trading, usage patterns are shifting. Kerbrat noted growing traction in staking services on Robinhood, alongside rising curiosity about decentralized finance applications.

The diversification trend comes amid sustained outflows from US spot Bitcoin ETFs, which have recorded approximately $3.8 billion in withdrawals over five consecutive weeks, underscoring ongoing market caution even as retail engagement broadens.

Disclaimer

This content is for informational purposes only and does not constitute financial, investment, or legal advice. Cryptocurrency trading involves risk and may result in financial loss.