Analysts weigh in as Bitcoin and Ether face sharp pullback

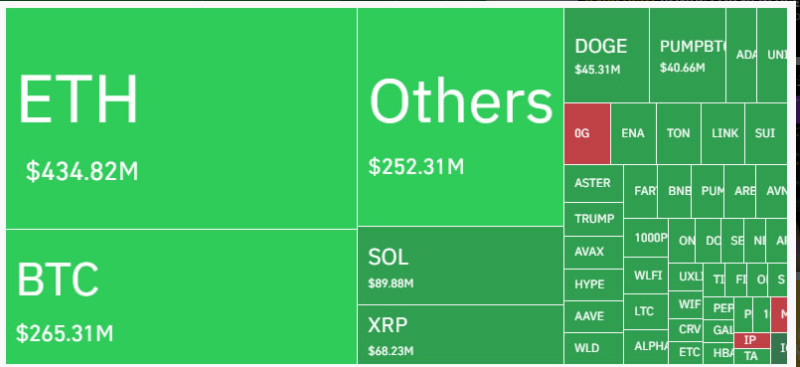

The cryptocurrency market endured one of its heaviest shake-outs of the year, with over $1.8 billion in trader positions liquidated within 24 hours. The wipeout, driven largely by long positions in Bitcoin and Ether, sent shockwaves across the sector and reignited debates on whether this marks a final flush before recovery or if more downside risk remains.

According to market data, more than 370,000 traders were caught in the liquidation cascade, making it the largest long liquidation event of 2025. The sell-off came as Bitcoin fell below $112,000 and Ether slipped under $4,150, dragging total crypto market capitalization to $3.95 trillion — a $150 billion decline in a single day.

Overleveraged positions under fire

Market observers pointed out that the correction was less about fundamentals and more about excessive leverage across derivatives markets. Real Vision founder Raoul Pal explained that such scenarios are common:

“The crypto market gears up for a breakout, traders pile in with leverage, the move fails at first attempt, and everyone gets liquidated. Only then does the real breakout occur.”

Researcher Bull Theory echoed this sentiment, emphasizing that altcoins carried disproportionate leverage compared to Bitcoin, which amplified the scale of liquidations. Ether alone saw liquidations above $500 million, more than double those of Bitcoin.

Support levels and outlook

Despite the turmoil, analysts argue the event could represent a healthy market reset. Tony Sycamore, IG market analyst, noted that Bitcoin’s pullback is technical in nature:

“A dip back into the $105,000–$100,000 support zone, which includes the 200-day moving average at $103,700, would make sense. It would flush out weaker hands and set up a strong buying opportunity heading into year-end.”

Industry strategists such as Nassar Achkar of CoinW highlighted that while painful, the liquidation wave may ultimately strengthen the long-term bull structure.

Historically, September has been a volatile month for Bitcoin, recording losses in 8 of the past 13 years. Yet the asset remains up around 4% this month, with many investors pinning hopes on the historically bullish “Uptober” for a rebound.

Disclaimer

This content is for informational purposes only and does not constitute financial, investment, or legal advice. Cryptocurrency trading involves risk and may result in financial loss.