The cryptocurrency market endured one of its most turbulent weeks in recent history . Market cap declined sharply as Bitcoin and major altcoins saw steep price drops, heavy liquidations, and continued outflows from investment products.

Bitcoin and Ethereum Price Action

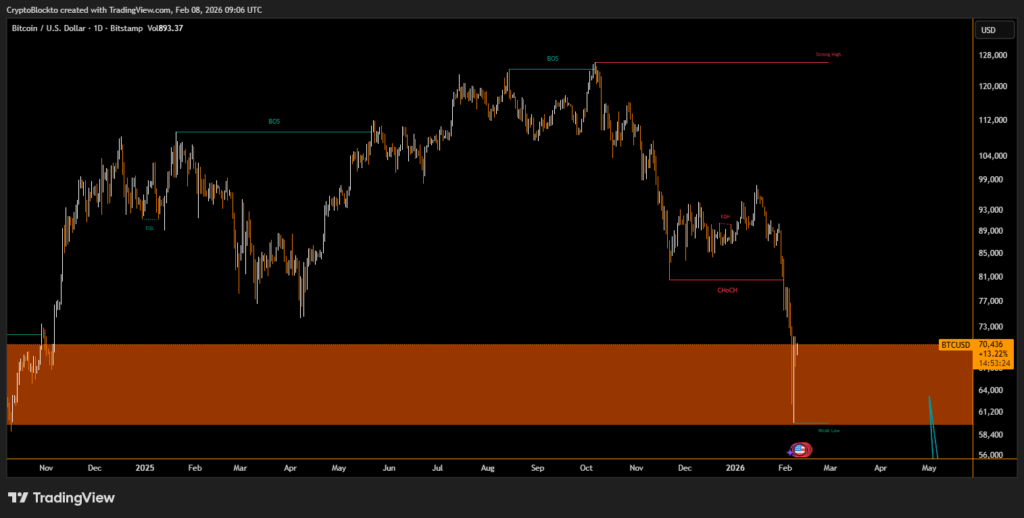

Bitcoin began the week near $79,400 but plunged below $60,200 by February 6 before a modest rebound above $70,000. Over the full week, BTC lost roughly 16% of its value amid a liquidation-led selloff and broader risk-off sentiment.

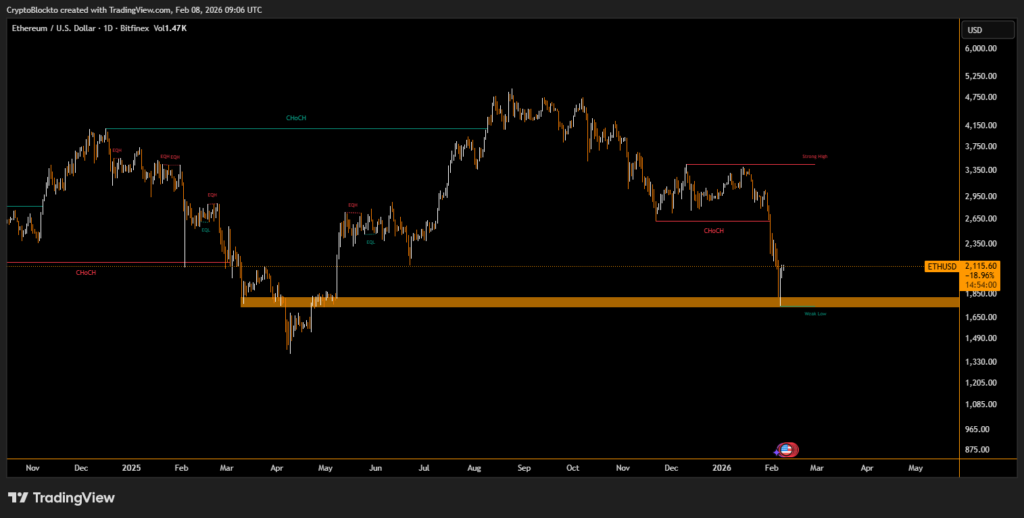

Ethereum fell even more sharply, declining about 22% over the same period, with ETH briefly trading near $1,775. These moves coincided with the total crypto Fear & Greed Index sinking into extreme fear territory, reflecting widespread trader discomfort and volatility. Total liquidations across crypto futures exceeded $2 billion on key days, driven by forced unwinding of leveraged long positions.

Solana, XRP and Altcoins

Solana and XRP also suffered significant losses, with SOL down roughly 24% and XRP sliding near double-digit weekly declines before a recovery attempt later in the week. XRP showed signs of resilience Friday with rebounds above key levels, helped by increased trading volume and ecosystem developments.

ETF Flows and Institutional Trends

Institutional sentiment remained cautious. Spot Bitcoin ETFs recorded net outflows of approximately -$358.5 million from Feb 2–6, while Ethereum ETFs saw around -$170.4 million in redemptions. These negative flows underscored sustained de-risking from institutional holders rather than short-term retail panic. Broader industry data suggests multi-month outflows from crypto funds remain elevated as risk assets are repriced.

Gold Price Movement

Gold joined risk assets in weakness, with prices breaking below psychological support levels. Technical analysis points to significant drops near major psychological levels, suggesting short-term bearish pressure in precious metals as traders repriced risk across markets.

Experts highlight that widespread liquidations and macro uncertainty — particularly monetary policy signals — continue to dominate price action. Technical indicators suggest that breaching key support levels could open paths for further downside unless fresh demand re-emerges. Significant drawdowns often precede relief rallies once fear subsides. Continued monitoring of ETF flows, funding rates, and macro signals will be crucial in assessing potential stabilization or further volatility ahead.

Disclaimer

This content is for informational purposes only and does not constitute financial, investment, or legal advice. Cryptocurrency trading involves risk and may result in financial loss.