The future of the crypto industry in the United States may depend less on Washington and more on real-world adoption if lawmakers fail to pass a long-awaited market structure bill. According to Bitwise, the industry faces a narrow window to secure its place in everyday finance.

Crypto Market Structure Bill and Regulatory Risk

Bitwise Chief Investment Officer Matt Hougan warned that pending legislation in the US Senate is critical to locking in the current pro-crypto regulatory environment. The bill aims to clearly define how regulators oversee digital assets and divide responsibilities between agencies.

If the legislation stalls, Hougan cautioned that a future administration could easily reverse the current policy direction, leaving the industry exposed to renewed uncertainty.

Why Crypto Adoption Becomes Critical

Hougan said the industry would then have until 2029 to make crypto essential to daily economic activity.

“Crypto must become indispensable to regular Americans and the traditional financial system,” he noted.

He argued that widespread use of stablecoins, tokenized stocks, and blockchain-based financial tools could force lawmakers to support crypto regardless of political leadership.

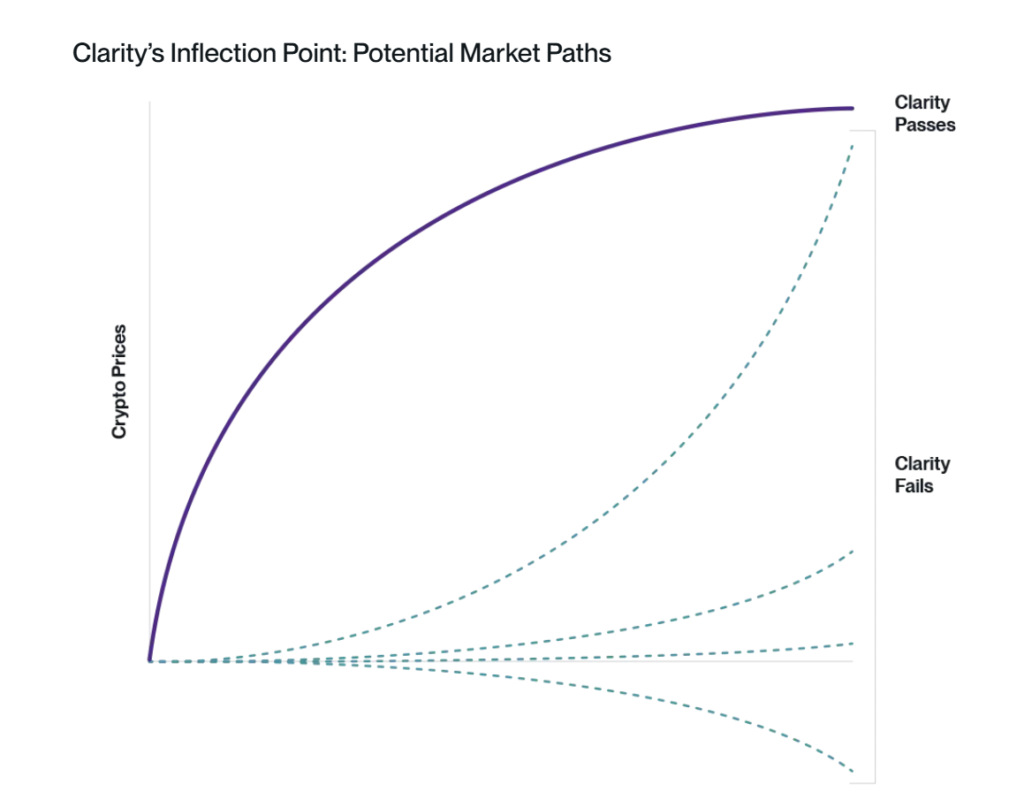

Two Possible Market Outcomes

Hougan expects a strong market rally, as investors would price in guaranteed growth for tokenization and digital payments.

Markets may enter a wait-and-see phase, where prices depend on measurable adoption rather than expectations.

Without real-world usage, crypto risks standing on a weak regulatory foundation.

While Hougan remains cautiously optimistic about legislative success, he warned that failure could mean a slower, more demanding growth path—one where crypto must prove its value through everyday use, not promises alone.

Disclaimer

This content is for informational purposes only and does not constitute financial, investment, or legal advice. Cryptocurrency trading involves risk and may result in financial loss.