Crypto Payments Banned Domestically, Yet Allowed Internationally?

While countries like China, Russia, Turkey, and Indonesia continue to ban crypto payments for domestic use, legal experts say that using crypto for purchases abroad may still be legal — creating a gray area in global digital asset regulation.

This growing trend is fueled by stablecoins like USDT, which have become a preferred method of payment for global transactions, especially in countries with currency restrictions or high inflation.

Legal Experts Say: “Domestic Ban Doesn’t Mean Global Ban”

According to legal interpretations, crypto bans in many countries apply only within national borders or to resident citizens, not to purchases from foreign-based businesses.

“Turkish law does not apply when a citizen shops from an overseas company,” said one legal advisor, highlighting that foreign crypto payments aren’t regulated under local restrictions.

Similarly, Russia’s Federal Law No. 259 bans crypto payments within Russia, but does not prohibit payments made internationally, as long as the transaction occurs outside the jurisdiction or is not used for contracts under Russian law.

Georgia: A Case Study in Regulatory Gaps

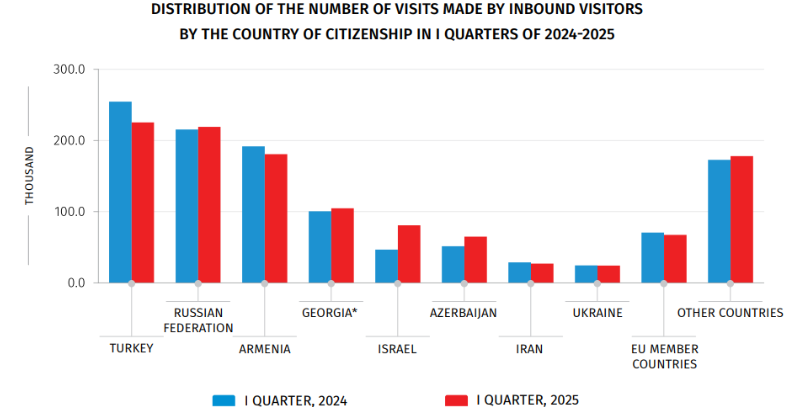

Recently, Tripzy, a Georgian travel company, began accepting Tether (USDT) via CityPay, allowing travelers to book services using crypto. Given that Russia and Turkey are among Georgia’s top tourism markets, this raises important regulatory questions.

There is no explicit prohibition on Russian or Turkish citizens using stablecoins abroad. This legal gap could enable continued crypto adoption through cross-border commerce, even in countries with strict domestic rules.

FATF and Global Scrutiny Could Be on the Horizon

Despite these legal loopholes, global regulatory bodies such as the Financial Action Task Force (FATF) have raised concerns about stablecoins being used for illicit activity, including by sanctioned states and terrorist actors.

“Patterns of cross-border crypto use may trigger pressure from the international financial system,” warned one compliance expert.

The FATF has pledged a new report on stablecoins by Q1 2026, signaling growing attention to jurisdictional mismatches and regulatory arbitrage in crypto payments.

Bottom Line: Legal Today, Scrutinized Tomorrow

While paying with crypto abroad may be legal for residents of countries with bans, this space remains complex and fluid. Businesses accepting crypto from restricted jurisdictions could face future compliance pressure, especially as global AML frameworks tighten.

Staying compliant means watching not just local laws, but international trends.

Disclaimer

This content is for informational purposes only and does not constitute financial, investment, or legal advice. Cryptocurrency trading involves risk and may result in financial loss.