Market mood strengthens as Bitcoin outlook improves across key sentiment indicators

Crypto Fear Index Finally Recovers After 18 Days

The broader crypto market has begun showing signs of renewed confidence after spending 18 consecutive days in “extreme fear.” The shift arrives as the Crypto Fear & Greed Index rose to a score of 28, moving sentiment into the Fear zone for the first time since early November. This recovery comes during a month that historically favors strong Bitcoin performance, adding weight to speculation that a market rebound may be forming.

Sentiment Indicators Signal a Potential Market Turning Point

During November’s prolonged downturn, analysts noted that the index hit its most intense fear levels of the current cycle, prompting discussions about whether a local bottom was forming. Historically, extreme fear readings have aligned with short-term Bitcoin lows, and several market observers suggested that the latest pullback could follow a similar pattern.

Evidence of strengthening sentiment appeared as Bitcoin edged back toward $92,000, with social data showing a noticeable rise in bullish commentary. Platforms tracking market mood highlighted increased discussions around price volatility, ETF inflows, and institutional accumulation, all supporting a gradual shift toward a more positive outlook.

Market Still Cautious Despite Improving Indicators

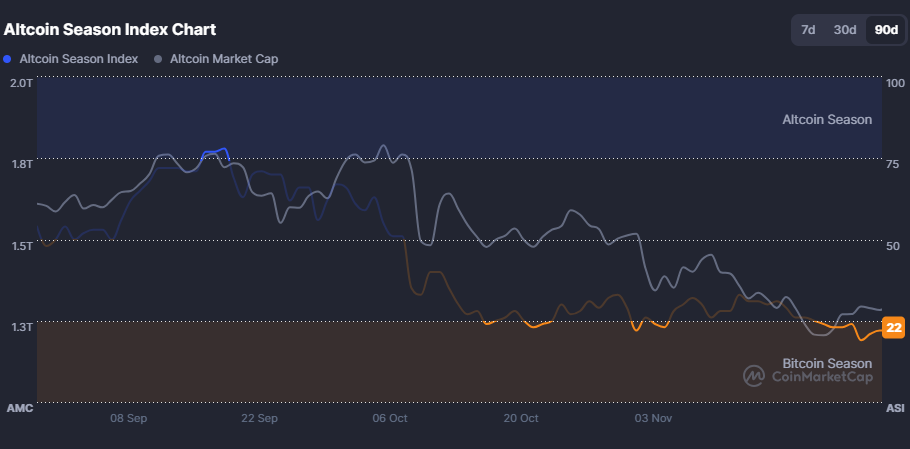

Although sentiment has improved, the broader market remains cautious. The Altcoin Season Index, currently at 22/100, reflects a strong tilt toward Bitcoin Season, signaling ongoing risk aversion among traders. Analysts also point to macroeconomic uncertainty, including heightened recession expectations, as a force keeping investors defensive.

Some experts believe this environment has created an asymmetric risk-reward scenario, noting that similar conditions last appeared during major market dislocations. As sentiment continues to climb out of extreme fear, investors are watching closely for confirmation that the recent recovery represents a durable shift.

Disclaimer

This content is for informational purposes only and does not constitute financial, investment, or legal advice. Cryptocurrency trading involves risk and may result in financial loss.