Despite Bitcoin maintaining strong price levels in Q2 2025, crypto spot trading volumes on centralized exchanges (CEXs) fell sharply by 22%, according to the latest TokenInsight Exchange Report. This drop highlights a continued shift in trader behavior and market structure, even as broader sentiment appeared optimistic.

Spot Trading Falls to $3.6 Trillion

The report shows that spot trading volumes fell from $4.6 trillion in Q1 to just $3.6 trillion in Q2 2025 — a significant 22% decline. This marks the second consecutive quarter of falling spot activity after volumes reached $5.3 trillion in Q4 2024.

The downturn was driven primarily by declining altcoin trading activity and shrinking liquidity. Although Bitcoin traded steadily above $110,000 for most of the quarter, traders increasingly favored derivatives markets to manage risk and volatility.

MEXC and Bitget Defy the Trend

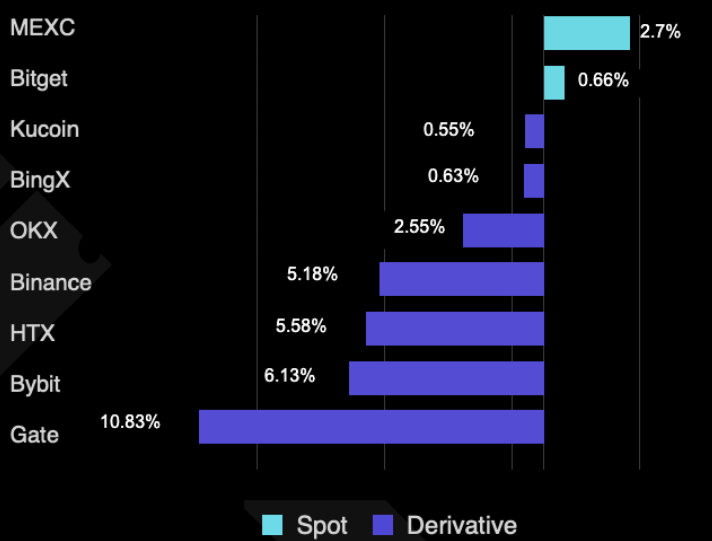

Not all platforms suffered from the spot trading slowdown. MEXC emerged as the top gainer, increasing its spot trading volume by 2.7% in Q2. Bitget also posted marginal growth of 0.7%, making them the only two exchanges to buck the broader trend.

By contrast, the average daily spot trading volume fell to $40 billion, down from $52 billion in the previous quarter — reflecting the cautious stance of retail and institutional traders.

Derivatives Markets Remain Resilient

While spot markets faced pressure, crypto derivatives trading volumes showed resilience. Total derivatives volume in Q2 reached $20.2 trillion, only slightly down from $20.9 trillion in Q1 — a modest 3.6% decline.

This stability reflects growing reliance on leverage and hedging strategies, as traders seek to navigate market uncertainty without relying on traditional buy-and-hold spot positions.

Q3 Outlook: Weak Spot Activity Expected to Continue

Looking ahead, TokenInsight expects the spot market to remain subdued. The report projects spot volumes to hover between $3 trillion and $3.5 trillion in Q3, due to ongoing economic uncertainty, reduced altcoin trading, and liquidity constraints.

Disclaimer

This content is for informational purposes only and does not constitute financial, investment, or legal advice. Cryptocurrency trading involves risk and may result in financial loss.