September CPI data delayed by the US government shutdown expected to show 3.1% inflation, shaping expectations for Federal Reserve rate cuts and influencing crypto market trends.

Crypto investors are closely monitoring the upcoming US Consumer Price Index (CPI) report for September, which is set to be released on Friday after a government shutdown delay. Analysts expect the data to show annual inflation of around 3.1%, marking the first time this year that inflation could exceed 3%. The outcome is expected to play a crucial role in shaping market sentiment toward the Federal Reserve’s interest rate policy and the crypto market’s near-term momentum.

Inflation Expectations and Fed Rate Cut Outlook

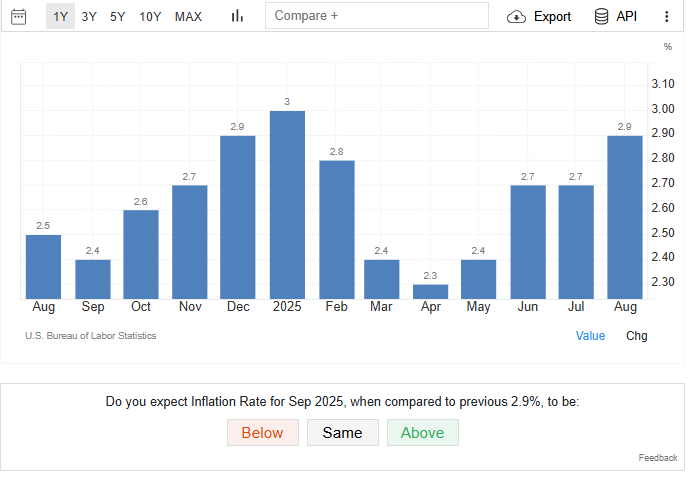

Economists forecast a 0.4% monthly increase and a 3.1% annual rise in inflation, according to data from Trading Economics. This would be the highest CPI reading since June 2024, raising questions about how the Fed might respond in its next meeting.

Market analyst Ted Pillows noted that if inflation comes in at or above 3.1%, it could slightly reduce the odds of immediate rate cuts, but a softer reading near 3% “would be good for markets.”

Another prominent analyst, known as “Ash Crypto,” highlighted that readings below 3.1% would create a perfect setup for risk-on assets like Bitcoin and altcoins. “If the month-on-month increase remains modest, it will boost liquidity and encourage more aggressive rate-cut expectations,” he explained.

Fed’s Focus Shifts Toward Employment

While inflation remains a key data point, market strategists believe the Federal Reserve’s focus is now shifting toward the weakening labor market. “Even if CPI slightly exceeds expectations, it is unlikely to derail the Fed’s rate-cut path,” said Matt Maley, chief market strategist at Miller Tabak.

According to futures data, there is currently a 98.3% probability of a rate cut next week, with another potential cut expected in December. However, the ongoing government shutdown adds complexity to the broader economic outlook.

The global crypto market capitalization has risen 1.8% in the past 24 hours, reaching $3.8 trillion. Bitcoin (BTC) briefly climbed above $111,000 before stabilizing near $110,500. Analysts suggest that a milder CPI reading could further strengthen crypto’s bullish momentum, as lower inflation supports greater liquidity and investor risk appetite.

In summary, Friday’s CPI report will serve as a crucial signal for both traditional and crypto markets. While a hotter reading may cause short-term volatility, expectations remain that the Federal Reserve’s easing cycle will continue, keeping the crypto market on a cautiously optimistic path.

Disclaimer

This content is for informational purposes only and does not constitute financial, investment, or legal advice. Cryptocurrency trading involves risk and may result in financial loss.