Bitcoin continued a sharp decline through the last week of January, falling back below the $76,000 mark by January 31 after trading near $88,000 mid-week. The slide has taken BTC to levels last posted in late 2025, driven by tightening liquidity and broader risk-off sentiment. Bitcoin lost over 7 percent on the week, with increasing volatility before the weekend close.

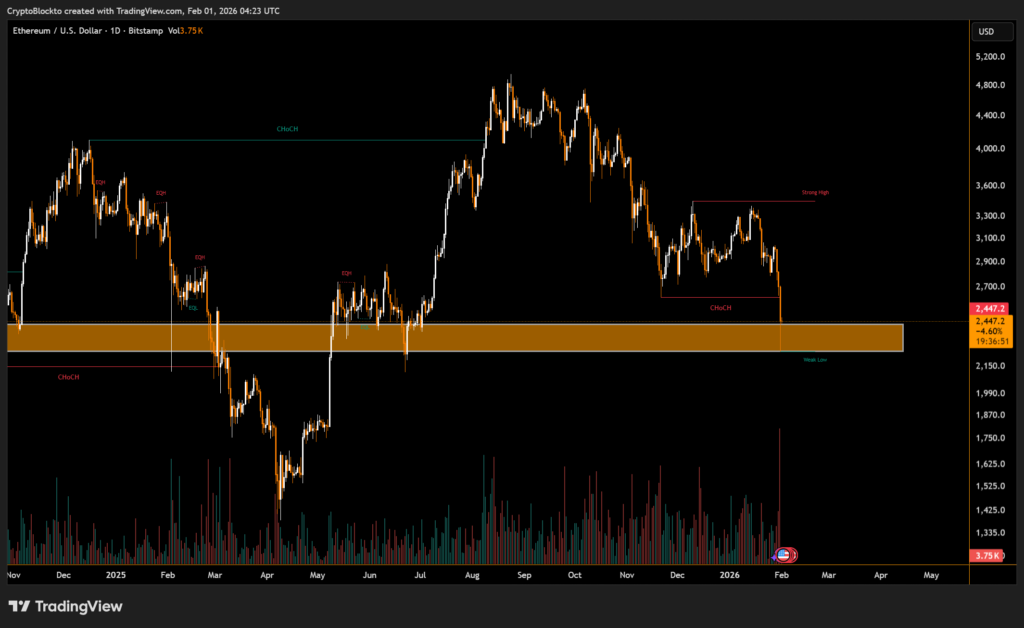

Ethereum followed suit, weakening more than bitcoin over the same period. ETH traded down toward the $2,300 ,2500 Range, causing more pronounced weekly losses than BTC.

Other major altcoins including Solana, XRP and Dogecoin also traded broadly lower, in line with the broader market pullback. Solana pulled back toward the low triple-digit range and Dogecoin hovered under $0.11, according to current price levels. XRP similarly softened, reflecting risk-off positioning in speculative crypto.

Market sentiment metrics for the crypto sector showed heightened fear, with total capitalization contracting alongside the downturn.

Gold and Traditional Commodities

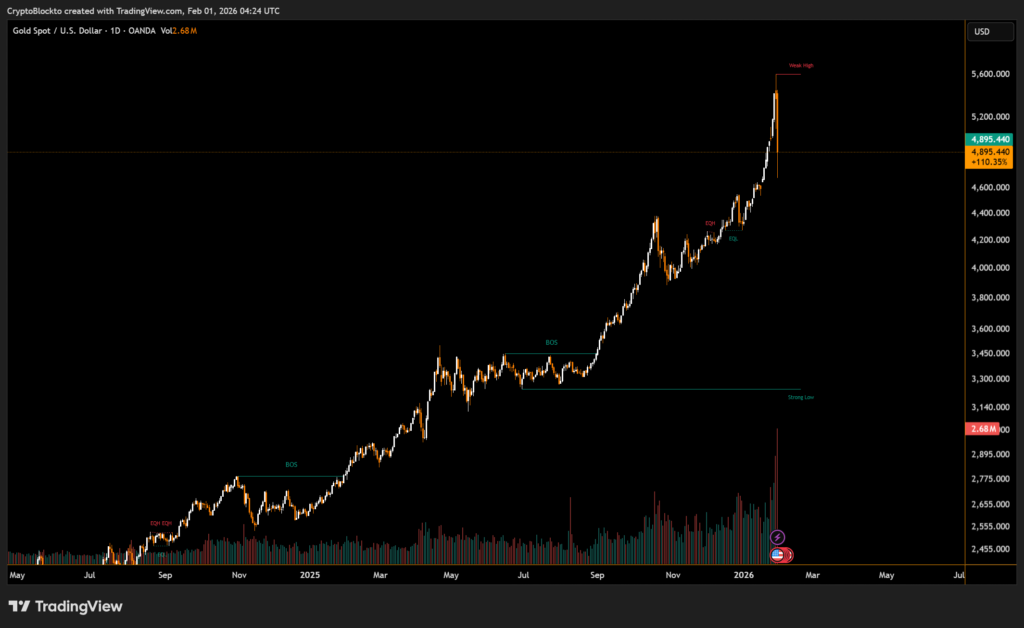

Gold saw historic price behaviour early in the week, rallying toward record price levels above $5,600 per ounce amid surging safe-haven demand before retreating slightly from those peaks. The precious metal’s volatility reflects investor repositioning amid macro stress.

Oil markets also reacted strongly to geopolitical risk. Brent crude climbed over $70 per barrel as concerns about supply disruption emerged following escalating tensions involving the United States and Iran near critical oil transit zones.

Geopolitical and Macro Drivers

Escalating U.S.–Iran tensions dominated global risk sentiment during the week, contributing to flight-to-safety moves in commodities and deepening sell-offs in risk assets like cryptocurrencies. Related market commentary linked the geopolitical backdrop and potential implications for oil supply routes to broader market volatility.

In financial markets, macro drivers such as shifts in monetary policy expectations and liquidity perceptions also weighed on digital assets. These influences compounded price pressure in both crypto and commodities through the final trading days of January.

The final week of January highlighted how macroeconomic stress, geopolitical concerns, and liquidity dynamics can intersect to pressure both crypto and traditional asset classes. Traders and investors remain focused on upcoming economic data, policy signals, and geopolitical developments entering February.

Disclaimer

This content is for informational purposes only and does not constitute financial, investment, or legal advice. Cryptocurrency trading involves risk and may result in financial loss.