Investor Kevin O’Leary says inflation pressure makes a December rate cut improbable, though Bitcoin is unlikely to face major downside.

Speculation around a potential U.S. Federal Reserve rate cut in December is intensifying, yet investor Kevin O’Leary says he is not positioning his portfolio for such a move. Despite widespread market expectations for easing, he argues the economic backdrop suggests the Fed may stay put — and that Bitcoin is unlikely to be significantly affected either way.

O’Leary Pushes Back on Rate-Cut Optimism

O’Leary, speaking in a recent interview, said he sees “a lot of inflation in the system,” noting that the annual rate recently ticked up to 3%, its highest reading since January. With the Fed’s dual mandate of maintaining employment and stabilizing prices, he believes policymakers have “several reasons to stay cautious.”

Even so, market gauges tell a different story. The CME FedWatch Tool currently assigns nearly 90% odds to a December rate cut, reflecting strong investor expectations for looser financial conditions.

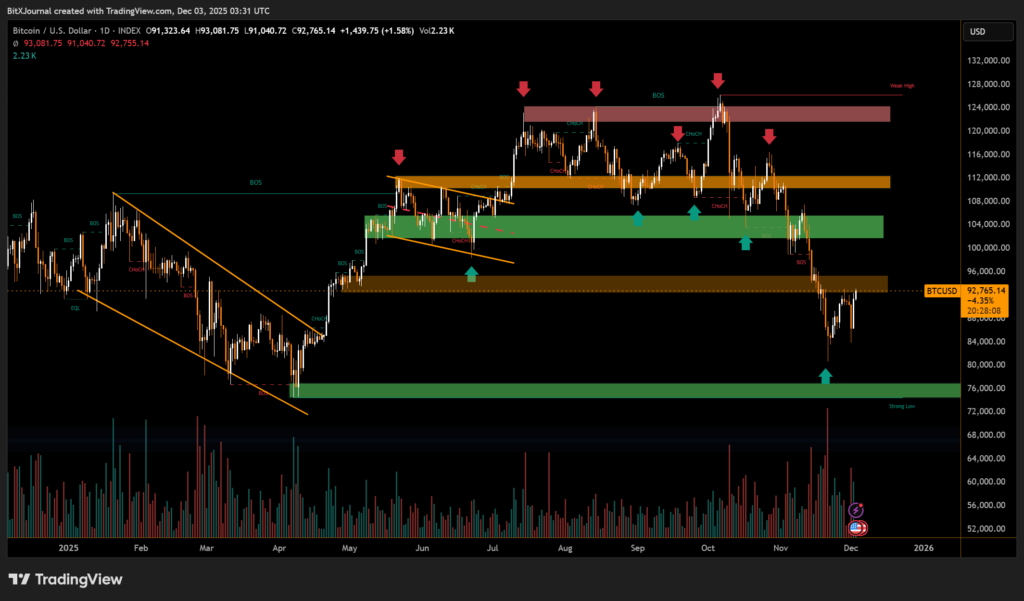

While traders generally view rate cuts as bullish for risk assets, O’Leary does not expect the Fed’s December decision to disrupt Bitcoin’s trajectory. He said the asset has “found a level for now” and is likely to drift within roughly 5% of its current price rather than experience a sharp swing.

Volatile Rate Expectations Ahead of Decision

Market pricing has fluctuated sharply in recent weeks. Odds for a December cut fell to 33% in mid-November before surging again after dovish remarks from Federal Reserve officials. Following rate cuts in September and November, many investors assumed a continued easing path, though the latest signals have complicated that outlook.

For now, O’Leary maintains that whether or not the Fed moves next month, Bitcoin’s short-term stability appears intact.

Disclaimer

This content is for informational purposes only and does not constitute financial, investment, or legal advice. Cryptocurrency trading involves risk and may result in financial loss.