In a bold move reflecting the growing convergence between traditional finance and digital assets, DigiAsia Corp (NASDAQ: FAAS) has announced plans to raise up to $100 million to acquire Bitcoin (BTC) as part of a strategic treasury reserve initiative. The announcement, made on May 19, triggered an immediate market response, with DigiAsia shares surging by over 90% before settling in after-hours trading.

Strategic Shift: DigiAsia Bets on Bitcoin

DigiAsia, a Jakarta-based fintech firm, aims to become one of the first Southeast Asian publicly traded companies to integrate Bitcoin into its core financial operations. The company revealed that it will allocate up to 50% of its future net profits toward acquiring Bitcoin in addition to raising external capital for initial purchases.

The company believes this strategy will not only strengthen its balance sheet but also signal long-term confidence in digital assets as a store of value.

“We believe Bitcoin represents a compelling long-term investment and a foundational layer for modern treasury diversification,” said Prashant Gokarn, Co-CEO of DigiAsia.

Market Response: Volatile but Promising

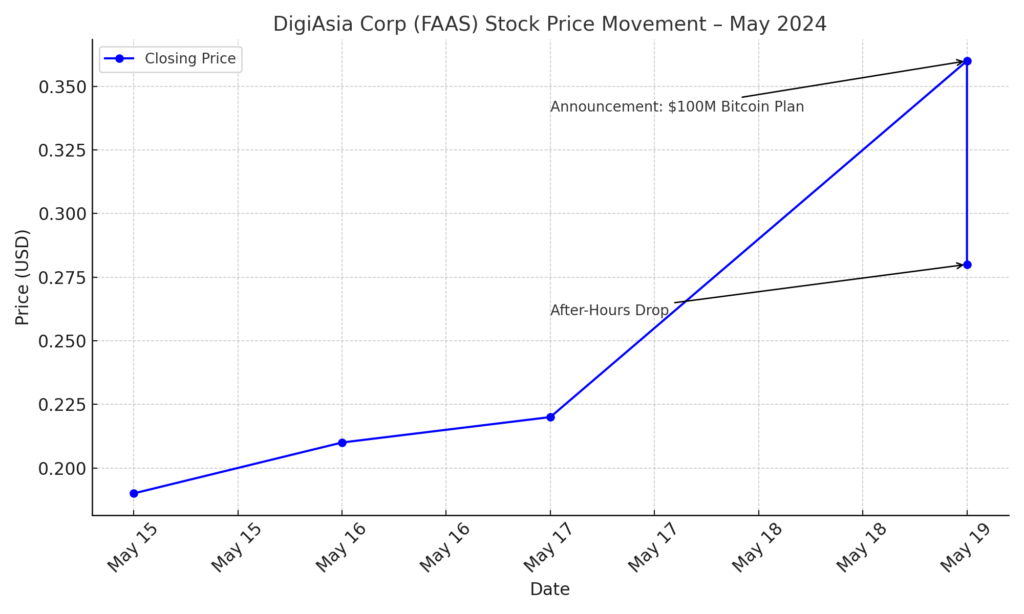

DigiAsia’s stock soared following the news, jumping 91% during regular trading hours to close at $0.36 per share. However, after-hours trading saw a 22% decline, bringing the price down to $0.28. Despite the temporary rally, the stock remains down over 50% year-to-date, having previously reached highs of nearly $12 in early 2024.

Market analysts noted that while the announcement injected enthusiasm into the stock, investors are also watching closely to see how the capital raise and Bitcoin acquisition strategy unfold.

Funding Plans and Yield Strategy

To fund its Bitcoin acquisition, DigiAsia is considering various options including:

- Convertible notes

- Equity-linked offerings

- Structured crypto finance instruments

In addition to holding Bitcoin on its balance sheet, DigiAsia also plans to generate yield from its crypto assets through institutional lending, staking, and other decentralized finance (DeFi) mechanisms. This strategy mirrors that of other institutional investors seeking to optimize Bitcoin holdings beyond simple buy-and-hold tactics.

Industry Context: Following MicroStrategy’s Lead?

DigiAsia’s announcement places it in the company of high-profile firms like MicroStrategy, which holds over 576,000 BTC, making it the largest corporate holder of Bitcoin globally. The move reflects growing corporate confidence in Bitcoin as a long-term hedge against inflation and a diversification tool.

In its latest earnings report, DigiAsia reported $101 million in revenue for 2024, representing a 36% year-over-year increase, and is projecting $125 million in revenue for 2025 with $12 million in expected EBIT.

Conclusion

DigiAsia’s aggressive push into Bitcoin signals a transformative shift in treasury management and fintech innovation. As the company works to raise $100 million and redirect future profits into crypto, it joins a growing list of institutions treating Bitcoin as a strategic asset. While investor sentiment remains mixed in the short term, the move could have long-term implications for DigiAsia’s positioning in both the crypto and fintech markets.