Technical Breakdown Signals ‘Death Cross’ Formation Amid Rising Selling Pressure

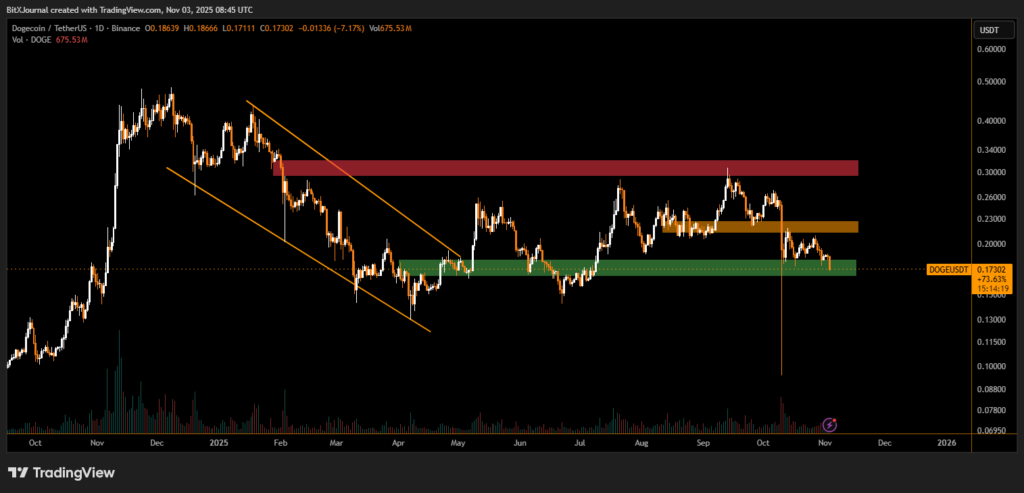

Dogecoin (DOGE) extended its losses on Friday, sliding 7.12% to $0.173 as broader market sentiment weakened and long-term holders began offloading positions. The decline came amid a deteriorating technical structure, with the meme-based cryptocurrency now testing a major support zone near $0.17, a level that previously acted as a springboard for rebounds in May and July.

The DOGE/USDT chart indicates a notable shift in momentum following several failed attempts to reclaim resistance near $0.23–$0.25. Price action has recently crossed below the 50-day moving average, aligning with the 200-day average—a formation commonly referred to as a “death cross”, signaling potential continuation of downward pressure in the near term.

“The technical picture for Dogecoin has weakened considerably since early October,” said BitXJournal market strategists. “Breaking below $0.18 puts the next demand level around $0.15 into focus. If that fails, DOGE could retest the $0.13 area seen in early Q2.”

Trading volume rose sharply to 674 million DOGE, suggesting heavier activity from large wallets and long-term holders exiting their positions. This coincides with a broader risk-off sentiment among retail traders, who appear to be rotating capital toward more stable large-cap assets.

Despite the decline, analysts note that Dogecoin’s long-term structure remains intact above $0.15, where the chart shows historical buying interest. “If DOGE can hold the $0.17–$0.18 range and reclaim $0.20 in the coming days, we could see renewed accumulation and a short-term reversal,” another BitXJournal technical analyst noted.

In summary, Dogecoin faces key technical challenges as it consolidates below $0.18, with downside risk lingering while the “death cross” pattern remains active. However, holding above structural support zones could limit losses and provide a foundation for recovery once selling pressure eases.

Disclaimer

This content is for informational purposes only and does not constitute financial, investment, or legal advice. Cryptocurrency trading involves risk and may result in financial loss.