Dogecoin Technical Levels Tighten Ahead of Capital Inflows

Dogecoin is approaching a critical inflection point, with traders watching how the market reacts to the debut of Grayscale’s GDOG ETF, a development that has elevated discussions around institutional exposure to meme-assets.

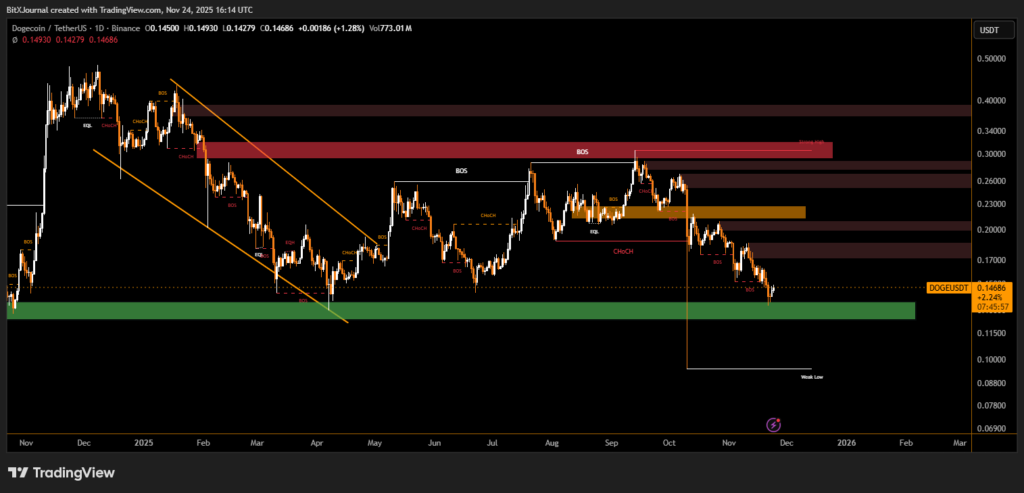

Dogecoin has spent the past several sessions consolidating near $0.147, hovering just above its final short-term support. The chart structure you provided shows price repeatedly rejecting the $0.1495 resistance, a level that has held since early November. With the ETF’s debut pushing DOGE into the broader spotlight, investors are assessing whether the market is preparing for a recovery bounce or another leg lower.

MARKET highlights a long series of Breaks of Structure (BOS) and Change of Character (CHoCH) signals, confirming a dominant bearish sequence since September. The supply zones between $0.17 and $0.30 remain untouched, suggesting strong overhead pressure.

The most immediate focus is the green demand zone between $0.136 and $0.145. As noted on your chart, this area represents the last meaningful support before exposure to a deeper sweep targeting the weak low near $0.088.

BitXJournal Market analysts say the current level is “a thin margin for bulls,” emphasizing that “any close below $0.144 will shift momentum back toward sellers and expose Dogecoin to a broader retracement.”

Impact of GDOG ETF Debut

The launch of the GDOG ETF has added a new dynamic. While flows into new crypto ETFs typically build slowly, early signs of demand could influence sentiment. One market strategist explained that “new vehicles tend to create a short-term narrative boost even if liquidity remains limited in early weeks.”

Still, resistance at $0.1495 remains the first major ceiling, and the chart clearly shows repeated rejections at this exact level.BitXJournal Analysts warn that “DOGE must reclaim and hold above $0.150 to neutralize the current downtrend.”

As long as the $0.144 support holds, the potential for a relief bounce remains intact. A break below it would underline the bearish continuation pattern already visible in your chart.

The next decisive move will depend on whether ETF-driven sentiment can inspire enough demand to challenge the entrenched resistance zones overhead.

Disclaimer

This content is for informational purposes only and does not constitute financial, investment, or legal advice. Cryptocurrency trading involves risk and may result in financial loss.