Rising Volume Supports DOGE Rebound, With $0.1470 Now Key to Holding the Bullish Structure

Dogecoin posted a 2.7% intraday surge, breaking through an important resistance level and signaling renewed interest from market participants. The movee came alongside a notable rise in trading volume, reinforcing the strength behind the breakout. Market data shows that retail traders were the primary force behind the upswing, while large-wallet transactions dropped to their lowest point in nearly two months.

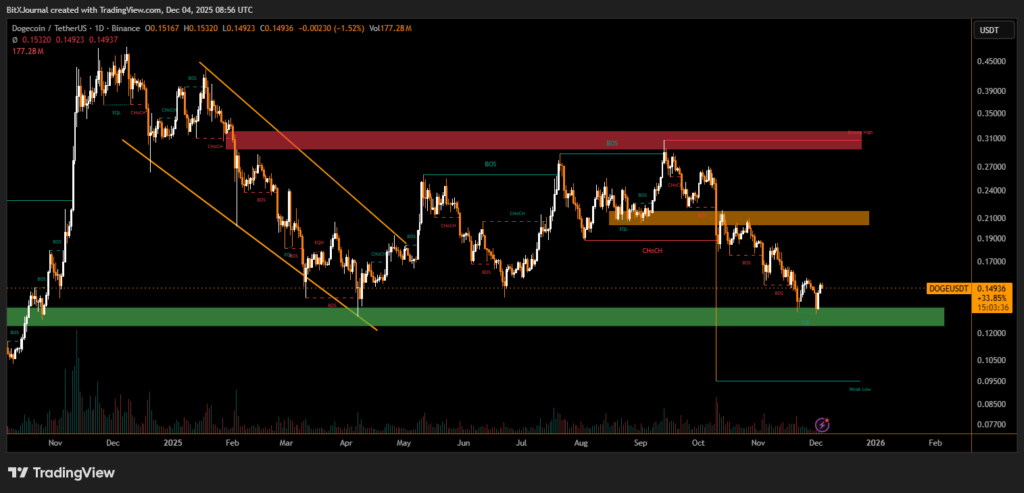

Market reflects a decisive push from the lower demand zone, where buyers previously defended price during repeated declines. As momentum strengthened, DOGE advanced into the mid-range, clearing the initial resistance that had capped upside attempts throughout late November. BitXJournal Analysts says that holding the $0.1470 level is critical, as it represents the structural midpoint of the current rebound and the boundary separating continuation from potential reversal.

Above this level, Dogecoin’s next technical objective sits at the $0.1530 target, a zone that aligns with prior consolidation and the upper boundary of the recent corrective phase. A sustained move beyond this point could shift the broader trend, opening the door toward higher resistance zones seen earlier in the cycle.

Despite weakening whale activity, retail demand continues to support short-term momentum. The chart illustrates tightening price action after a prolonged decline, suggesting that the market may be entering a recovery phase. For now, maintaining the breakout structure remains essential, as losing the $0.1470 level would expose DOGE to renewed downside pressure.

Dogecoin’s recent performance indicates improving sentiment, but follow-through from current levels will determine whether this breakout evolves into a broader trend reversal.

Disclaimer

This content is for informational purposes only and does not constitute financial, investment, or legal advice. Cryptocurrency trading involves risk and may result in financial loss.