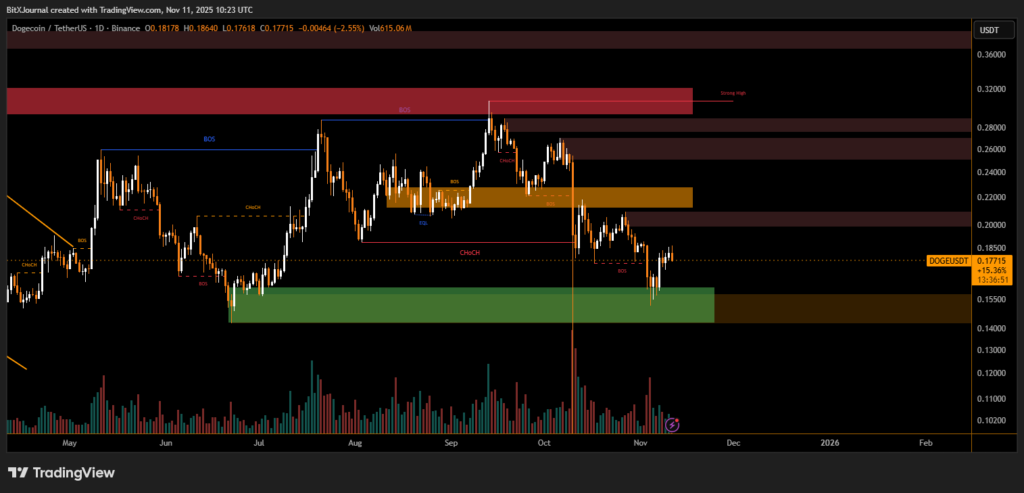

Momentum cools as traders lock in gains following a brief breakout; analysts eye $0.15 as key support for continuation.

Dogecoin Price Analysis

Dogecoin (DOGE) faced renewed volatility on Monday after a sharp intraday move above $0.18 was quickly met with selling pressure, bringing the price back to around $0.177. The popular meme coin, which has gained over 15% in the past week, is now consolidating near a key structural zone that could determine its next trend direction.

The latest chart data shows DOGE/USD forming a lower high, a pattern that often suggests waning short-term bullish momentum. The move follows a breakout from the $0.155–$0.160 support area, where strong buying interest previously triggered upward swings.

BitXJournal observers note that while short-term traders are booking profits, the broader setup remains structurally intact. The green demand block between $0.155 and $0.165 continues to act as a strong base, offering potential accumulation for medium-term holders.

Technical Outlook and Key Levels

On the daily chart, Dogecoin has been oscillating between $0.16 and $0.24, forming what analysts describe as a “compression zone” before a possible expansion phase. A decisive break above $0.185 could open the way toward $0.22–$0.24, while a failure to hold above $0.16 might expose the token to deeper correction targets near $0.14.

BitXJournal market strategist commented that, “Dogecoin remains range-bound, but the recent bounce from its demand area highlights that buyers are still defending key levels. The next breakout above $0.19 could reignite bullish continuation.”

Volume indicators show reduced activity compared to early November highs, suggesting momentary exhaustion among short-term speculators. Still, analysts maintain that as long as DOGE stays above $0.155, the macro bias remains constructive.

Dogecoin’s recent moves align with a broader stabilization in the crypto market. Bitcoin holds steady above $106,000, while Ethereum trades around $3,600, both providing a neutral environment for altcoins. The meme coin sector has shown signs of renewed participation, though sentiment remains cautious amid profit-taking phases.

In the near term, Dogecoin’s price action will likely revolve around the $0.18 psychological barrier. Sustained closes above this level could validate a bullish recovery, while repeated rejections might confirm a short-term correction. Traders continue to monitor volume and reaction around $0.16, as that remains a key determinant of the next directional move.

Disclaimer

This content is for informational purposes only and does not constitute financial, investment, or legal advice. Cryptocurrency trading involves risk and may result in financial loss.