Meme-Asset Slides Toward Major Support; Traders Eye Key Levels for Stabilization

Dogecoin continued its downward trajectory, shedding roughly 9% in the latest session as momentum weakened across speculative altcoins. The move drove the token toward a critical demand zone near the mid-$0.16 region, where price has historically attracted dip-buyers. However, the current reaction remains muted, underscoring cautious sentiment as broader liquidity thins.

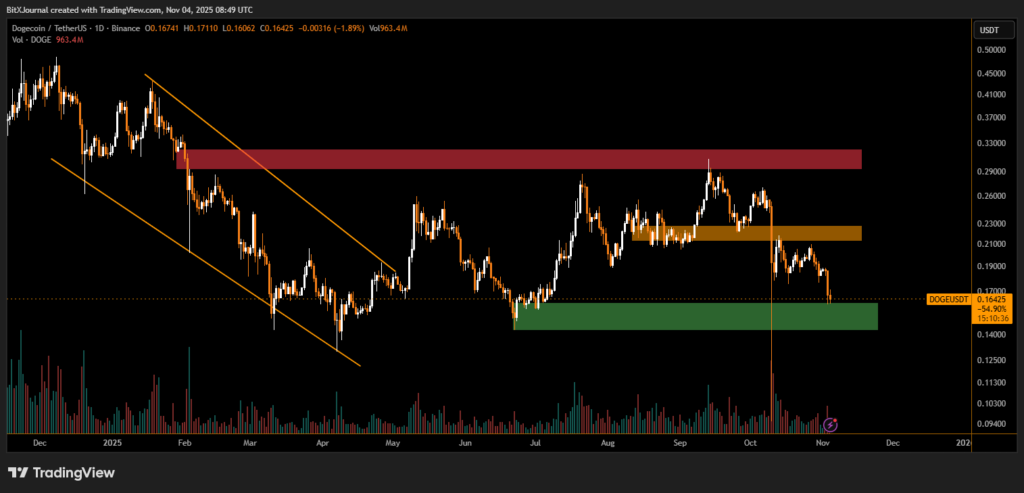

The chart shows a clear breakdown from a short-term consolidation range following repeated failures to reclaim resistance near $0.23. Earlier in the year, DOGE escaped a prolonged descending channel, sparking optimism among momentum traders. Yet recent price action has reversed that bullish structure, leaving the asset hovering above a significant support band watchers consider essential for maintaining medium-term trend stability.

Market technicians point to key thresholds in the days ahead. A sustained defense above approximately $0.165 would help prevent deeper unwinding into the lower range, while a daily close above $0.18 is widely viewed as necessary to challenge prevailing bearish momentum and reset upside prospects.

“This latest leg lower fits a pattern of controlled selling rather than capitulation,” noted BitXJournal market analyst tracking dog-themed assets. “But without strong participation on rebounds, sellers remain in command. The first signal of strength would be a decisive reclaim of the immediate resistance zone.”

Volume spikes on down-moves compared to modest upticks during relief rallies suggest traders are treating current bounces as temporary. That behavior aligns with weakening risk appetite across tokens that typically thrive on speculative capital flows and social sentiment.

Fundamentally, DOGE continues to benefit from broad recognition and periodic network development chatter, but price behavior is currently guided by market structure rather than narrative. Macro traders suggest near-term direction could hinge on broader crypto volatility and liquidity rotation patterns rather than asset-specific catalysts.

“This market rewards patience right now,” BitXJournal digital-asset strategist said. “A hold here could create a base, but confirmation demands higher lows and regained levels, not just reactionary pumps.”

As Dogecoin approaches historical demand territory, traders are monitoring whether value buyers step in to defend the structure or if continued weakness opens the door toward deeper price zones. For now, momentum favors disciplined risk management as the market seeks clarity.

Disclaimer

This content is for informational purposes only and does not constitute financial, investment, or legal advice. Cryptocurrency trading involves risk and may result in financial loss.