DOGE/USDT Tests Critical Weekly EMA Support

Dogecoin (DOGE) experienced a 5% decline this week, testing key weekly exponential moving average (EMA) support as bearish pressure dominated the market. The sharp movement unfolded within a $0.0121 range, confirming a lower-high, lower-low structure, signaling continued caution for traders.

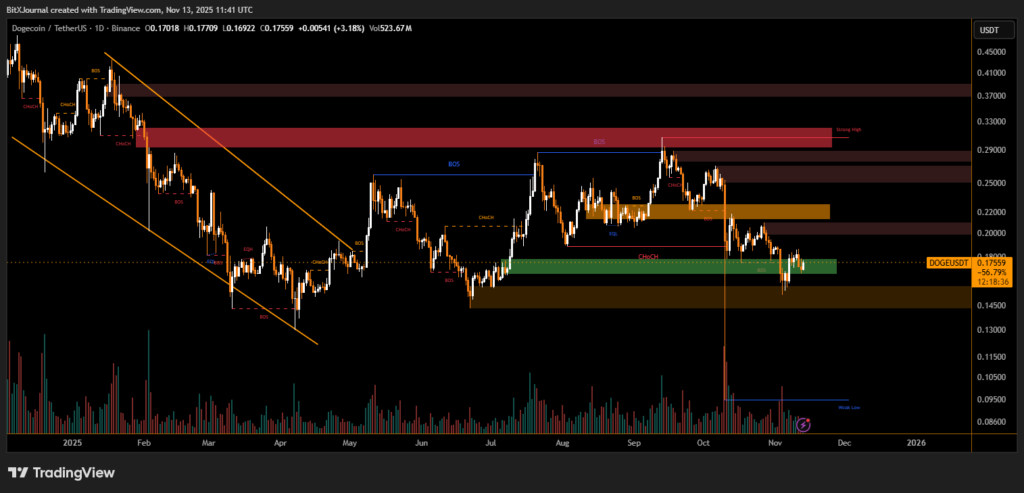

Technical analysts note that the current price action highlights significant supply and demand zones. The green support area around $0.17 acted as a temporary floor, while resistance levels at $0.22 and higher remain critical for any sustained bullish reversal.

Bears Control Short-Term Trend

BitXJournal Market observers point out that bearish dominance has been evident since the price broke below previous support clusters in early November. The formation of lower highs (LH) and lower lows (LL) indicates a continuation of the downtrend, putting pressure on Dogecoin to maintain support above the weekly EMA.

“DOGE is currently navigating a crucial support zone, and a clear break below this level could trigger further downside toward $0.15,” BitXJournal technical strategist commented. “Traders should watch volume spikes closely, as high selling pressure could accelerate the bearish trend.”

Critical Levels and Potential Reversal Zones

The orange and brown demand zones from previous months, near $0.145–$0.15, represent potential reversal areas if the current support fails. Conversely, reclaiming the $0.22 resistance level could signal a short-term bullish breakout, attracting momentum traders.

Volume analysis shows a moderate spike during the recent decline, suggesting that selling pressure is gaining traction, but the lack of extreme volume indicates that a major capitulation has not yet occurred.

“Monitoring both the weekly EMA and nearby demand zones is essential,” the analyst added. “DOGE could consolidate here for several sessions before attempting any meaningful recovery.”

While Dogecoin remains under short-term bearish pressure, the coin continues to find technical support in critical zones, offering trading opportunities for cautious investors. Market participants are advised to watch for confirmation signals, including price stabilization above the EMA or a breakout above resistance, to assess potential entries.

For now, DOGE’s performance underscores the importance of disciplined risk management as bearish momentum shapes the near-term landscape.

Disclaimer

This content is for informational purposes only and does not constitute financial, investment, or legal advice. Cryptocurrency trading involves risk and may result in financial loss.