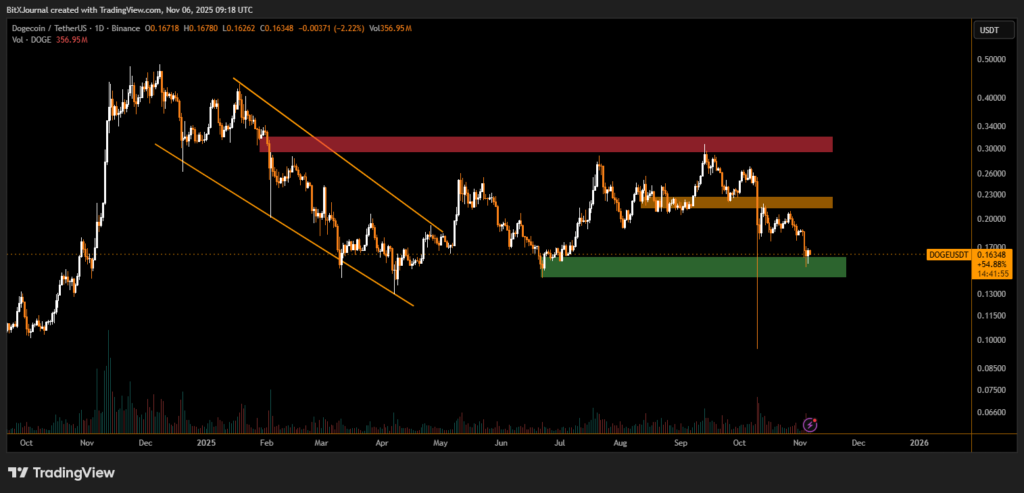

DOGE maintains its structure within a rising channel, signaling potential accumulation despite short-term selling pressure.

Dogecoin (DOGE) held its ground above the $0.16 support level during the latest trading sessions, as profit-taking pressure capped the meme coin’s early breakout attempts. The token’s ability to defend its ascending channel structure keeps the short-term outlook neutral-to-bullish, suggesting that buyers remain active around lower levels.

Support Defense and Market Context

Following a recent test of the upper boundary near $0.17, DOGE saw increased selling volume, largely attributed to short-term traders securing profits after last week’s modest rally. Despite this, the coin continues to post higher lows, indicating that the underlying demand zone between $0.155–$0.16 remains firm.

According to chart data, this area has served as a critical accumulation zone since mid-October. “As long as Dogecoin holds above $0.16, the broader trend remains constructive,” noted BitXJournal market analyst. “A confirmed break below this support could expose the token to deeper retracement levels near $0.145, but for now, the risk-reward remains balanced.”

Technical Indicators Point to Consolidation

The Relative Strength Index (RSI) currently hovers around neutral levels, reflecting a state of equilibrium between buyers and sellers. Meanwhile, the 20-day moving average acts as near-term resistance around $0.175, aligning with the top of the distribution zone seen in the chart. A sustained close above this level could mark the beginning of a renewed bullish phase, targeting $0.19–$0.21 in the coming days.

The broader market sentiment also plays a role. Bitcoin’s stability above $68,000 and moderate inflows into large-cap altcoins have provided a cushion for DOGE, which remains sensitive to liquidity shifts in the crypto market.

For now, Dogecoin’s price action reflects resilience rather than weakness, as bulls continue to defend key structural supports. If volume expands near the $0.17 mark, it could trigger a breakout from the current consolidation range. However, a breakdown below $0.16 would likely invite renewed bearish momentum and test the strength of the mid-term uptrend.

In short, DOGE’s ability to hold $0.16 keeps optimism alive, with the next few sessions likely to determine whether consolidation turns into a sustainable recovery.

Disclaimer

This content is for informational purposes only and does not constitute financial, investment, or legal advice. Cryptocurrency trading involves risk and may result in financial loss.