Sudden Sell-Off Triggers High Volatility

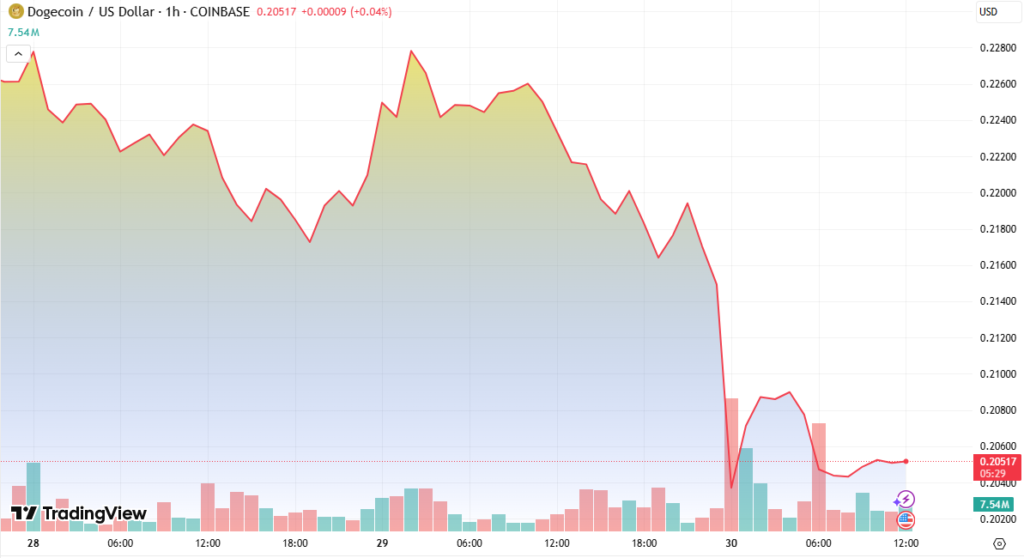

Dogecoin (DOGE) plunged over 10.6%, falling from $0.226 to $0.202 in a high-volume midnight sell-off. This sharp drop coincided with heightened market anxiety, pushing trading volume to 1.18 billion DOGE, a notable spike from its average levels.

The crash triggered intense selling pressure around 00:00, with DOGE losing 5.5% within minutes.

The price now consolidates between $0.202 and $0.206, reflecting a phase of market indecision and reduced volatility, as traders weigh the possibility of a recovery or further downside.

Technical Resistance and Chart Patterns

Technical analysis reveals a strong resistance at $0.217, a level DOGE has failed to reclaim since the drop. Price action shows signs of a possible double-bottom pattern — a bullish reversal signal — that could point toward price stabilization or even a breakout attempt.

A confirmed breakout above $0.217 could open the path toward $0.25, if momentum builds and buyer interest returns.

So far, however, Dogecoin has struggled to make significant upward progress, with a low-volume recovery bringing the price to $0.205 during a brief bounce between 09:43 and 09:56.

Traders Brace for Next Move

In derivatives markets, open interest in DOGE climbed 2.89% to $2.71 billion, signaling that traders are positioning for potential volatility ahead. This suggests growing speculation about whether DOGE will rebound or break lower in the coming sessions.

The consolidation zone between $0.202 and $0.206 remains critical, as a breakdown could push DOGE to retest earlier support zones.

Summary and Outlook

- DOGE dropped 10.6%, from $0.226 to $0.202 in a high-volume crash.

- Volume surged to 1.18B DOGE, marking panic-driven selling activity.

- Price is consolidating between $0.202 and $0.206, signaling indecision.

- Resistance at $0.217 must be broken for bullish momentum to resume.

- Open interest increased 2.89%, suggesting market participants are gearing up for more movement.

As the market absorbs the recent shock, traders and investors are watching closely for a decisive move. Whether DOGE will form a sustainable bottom or continue to decline hinges on upcoming volume surges and macroeconomic sentiment.